[ad_1]

Ozan Bingol

The “Law on Amendments to the Tax Code and Certain Laws”, which has long attracted public attention, was submitted to the Parliament by the Justice and Development Party Presidium on July 16, 2024.

The bill has 53 articles, including administrative and enforcement provisions. So, what is in the comprehensive bill? How will it affect our lives? Let me briefly introduce it below.

What is included in the comprehensive law?

In the omnibus bill proposal; there are regulatory proposals for 9 different laws. The law with the highest number of amendment proposals is the amendment to the Corporate Tax Law No. 5020, followed by the amendment to the Tax Procedure Law No. 213.

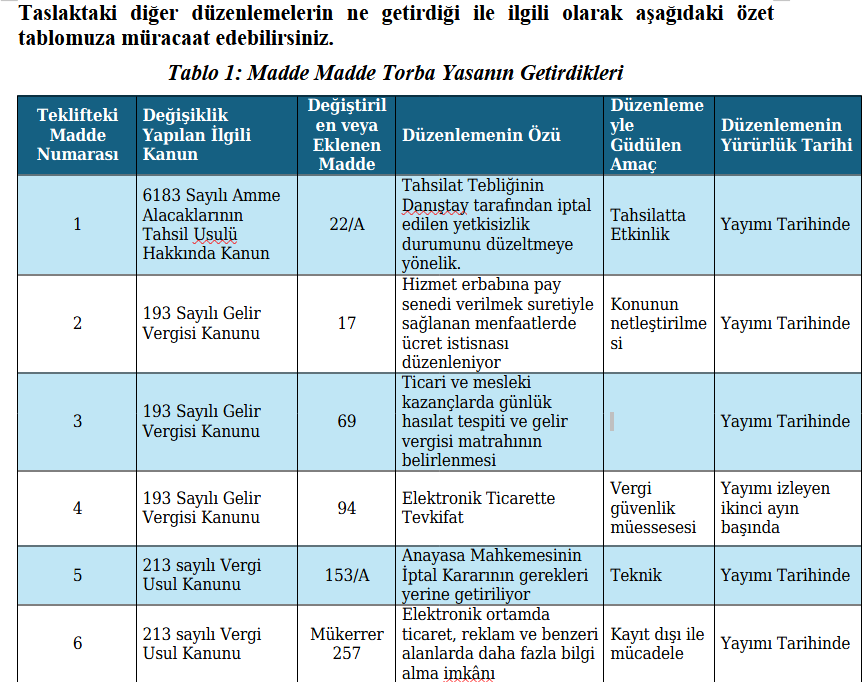

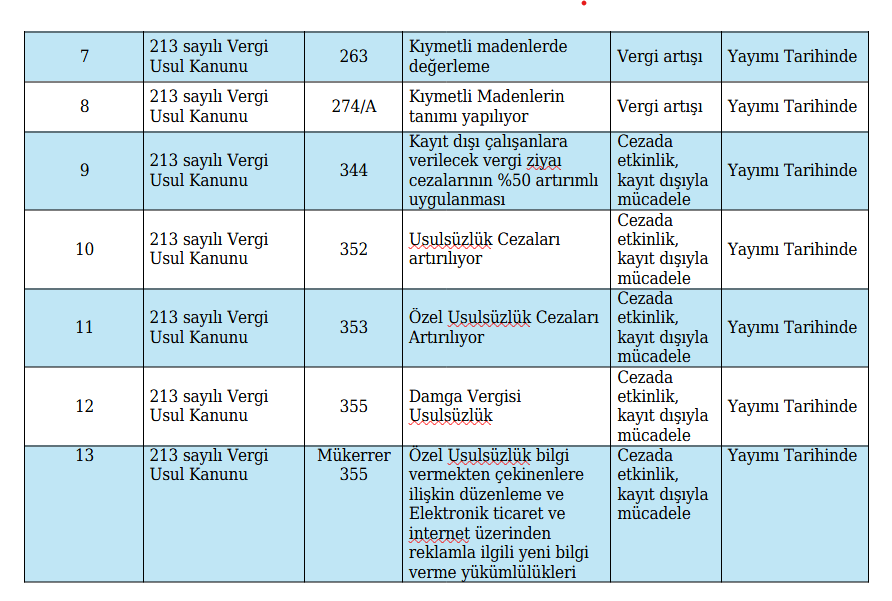

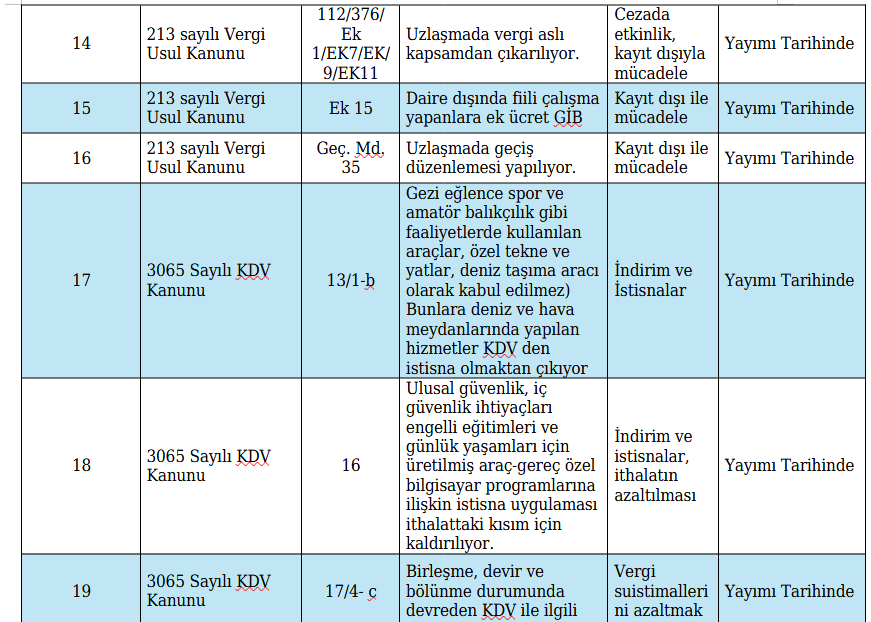

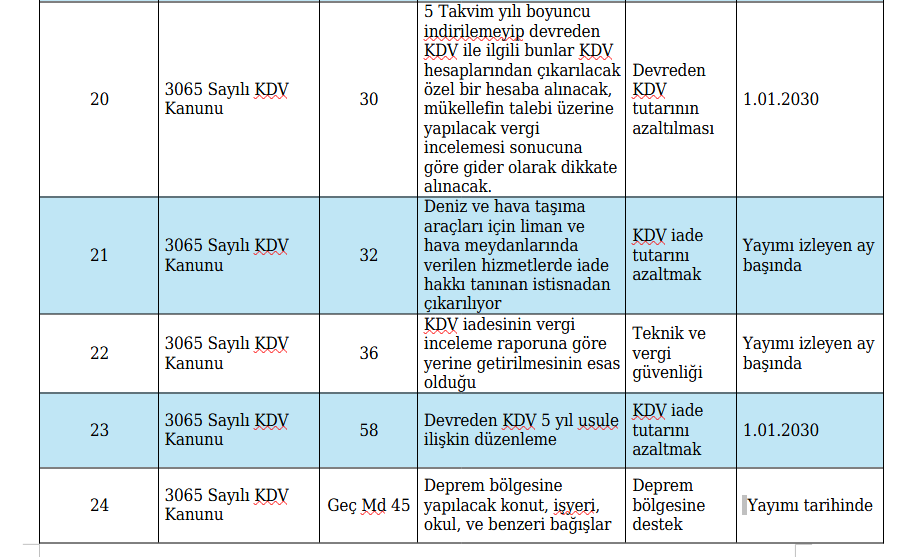

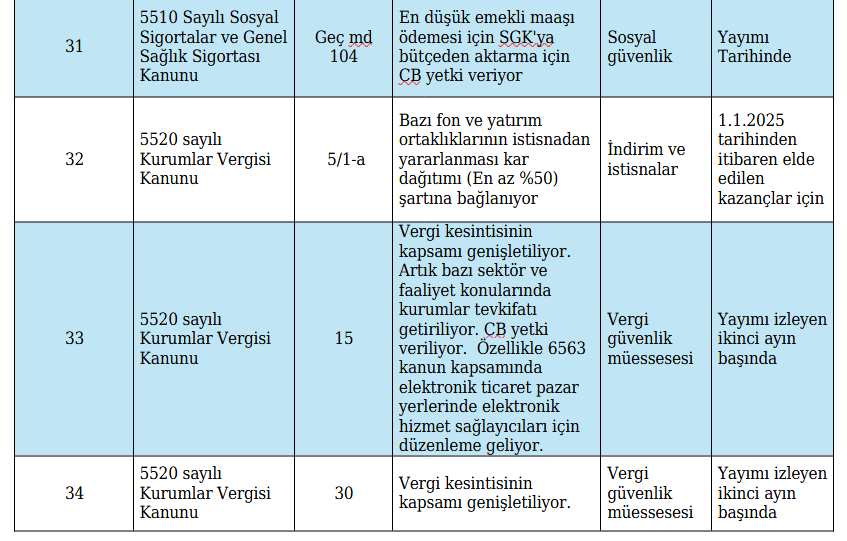

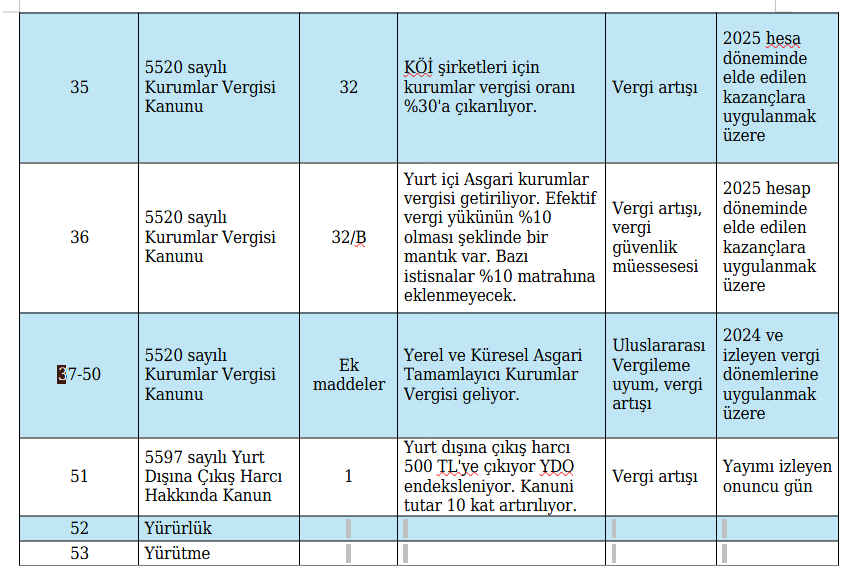

I will include a table at the end of the article showing what changes each provision in the omnibus bill brings to which provision of current law.

Below I briefly describe the main aspects of the comprehensive bill:

1- Minimum retirement wage

By amendment of the additional article 19 of Law 5510, the minimum pension increased to 12,500 liras. Thus, the minimum pension of 10,000 liras increased by 25%. We went through the usual process again. First it was said that there would be no salary increase, and the death was shown. Then, the retiree agreed to receive 2,500 liras.

As a result of this increase, Section 31 of the Omnibus Act authorizes the President to pay this additional amount from the budget through SSI.

The implementation clause of the regulation regarding the increase in the minimum pension is important. This article will take effect from the date of publication and will be implemented in the July 2024 pay period. In other words, regardless of when the bill becomes law, retirees will receive this increase starting in July 2024.

2- Increased outbound costs

The amount of the departure fee established by law has been increased tenfold, from 50 lira to 500 lira. The president can set this amount at 1,500 lira.

According to Law No. 5597 on travel expenses abroad, the travel expenses abroad were 50 liras. By presidential authorization, from March 18, 2022, this amount has been applied to 150 liras.

According to the bill, the 50 lira amount in the law will be increased tenfold to 500 lira.

The president’s power to triple the increase remains unchanged in the article. It will also increase at a rate that is revalued every year. So once the bill becomes law and the president says “I set it at 1500 lira”, the international departure fee becomes 1500 lira.

3- The lowest corporate tax in the world

The introduction of the “Local and Global Minimum Complementary Corporate Tax” reflects tax developments on the international stage. This issue concerns international companies. It is an issue that has been studied for a long time within the OECD and the regulation has caught up with this comprehensive bill proposal. The effective date is for 2024 and subsequent tax periods.

4- Minimum corporate tax in the country

This was one of the most discussed topics in the text that was “leaked” to the public. Two methods were proposed. One was a minimum corporate tax on turnover. In other words, even if a company made a loss, it would have to pay corporate tax at 2% of its turnover. This method was abandoned in the proposal. This is true. Because this method is unfair and unconstitutional, and encourages informality.

The proposed approach is that the tax payable by enterprises shall not be less than 10% of the base before deductions and exemptions. This means that the effective tax rate of the company shall not be less than 10%.

5- Daily income confirmation is coming soon

The Omnibus Act envisages income determination for taxpayers engaged in commercial or self-employed activities. Therefore, the monthly and annual income amounts of taxpayers will be determined by averaging the daily income amounts determined by the results of the taxpayers’ votes. When the determined income amount differs by more than 20% from the amount declared by the taxpayer, the taxpayer will be asked to provide an explanation.

6- Penalties are increasing

The penalties in the Tax Procedure Code are incredibly strong. The reason for this is to provide deterrence through tax penalties. However, it should not be forgotten that one of the most important criteria for the effectiveness and deterrent effect of tax penalties is proportionality.

I believe that the increase in penalties for special violations is very high and to a degree that would undermine the principle of proportionality.

I think the positive provisions in terms of penalties are that there is a difference in penalties between those who are completely unregistered and earn income without establishing any liability and those who are registered and evade tax. If you evade tax but do not establish any liability, your penalty will be increased by 50% compared to a registered taxpayer. The tax loss penalty will be changed from 1x to 1.5x, and the tax loss penalty for smuggling will be changed from 3x to 4.5x.

7- Tax subject is not within the scope of adjustment

We see that the omnibus bill reflects the general public perception that someone’s taxes can be eliminated through reconciliation.

Reconciliation will no longer be done based on the tax base. Only penalties will be included in the reconciliation. For example, if your main tax debt is 100 TL and the tax loss penalty is 100 TL, only the tax loss penalty will be the subject of reconciliation.

8- Partial solutions to the problem of deferred VAT

VAT is essentially a tax that should be borne by the final consumer. However, due to preferential tax rates, tax exemption applications, etc., taxpayers are left with a heavy VAT burden. There is a proposal in the Omnibus Bill regarding the VAT burden that has been transferred for many years. According to the proposal, the transferred VAT that cannot be compensated through the five-year discount will be excluded from the discount and credited to a special account. Within 3 years, taxpayers will be able to request a review and, depending on the results of the review, write off the amount as an expense.

Here, the VAT deduction right seeks to compensate by writing off the expenses, which provides a lower advantage to the taxpayer. Therefore, this is not a complete solution to the problem. But first of all, it is important because it shows a change in philosophy.

In summary;

A period awaits us in which penalties will increase, taxes will rise, and we will increasingly feel the breath of finance. I would also like to point out that this omnibus bill is only the first of a series of omnibus laws that will be introduced. After the opening of Parliament, the new omnibus law will appear as a new season episode of a new period.

If you ask what is not in this omnibus bill, I will say: there is no regulation to ensure tax justice for low-income people. Did you know that the provision to end the tyranny of tariffs is a single provision on the public procurement system that has become a sieve?

In conclusion; if the Turkish finance minister says “we will establish tax justice” or “we will strengthen tax justice”, we should be scared. Because most likely, their understanding of justice is not the same as our expectations of justice, and it never will be.

Calculation of basic salary in 2024

[ad_2]

Source link