[ad_1]

The EV board is preparing to submit a request to the cabinet to reduce consumption tax on hybrid electric vehicles, or HEVs, between 2028 and 2032 to stimulate investment, which is expected to help generate more than 50 billion baht of investment capital to build a modern auto parts production base. The number of car-sharing companies is expected to exceed five.

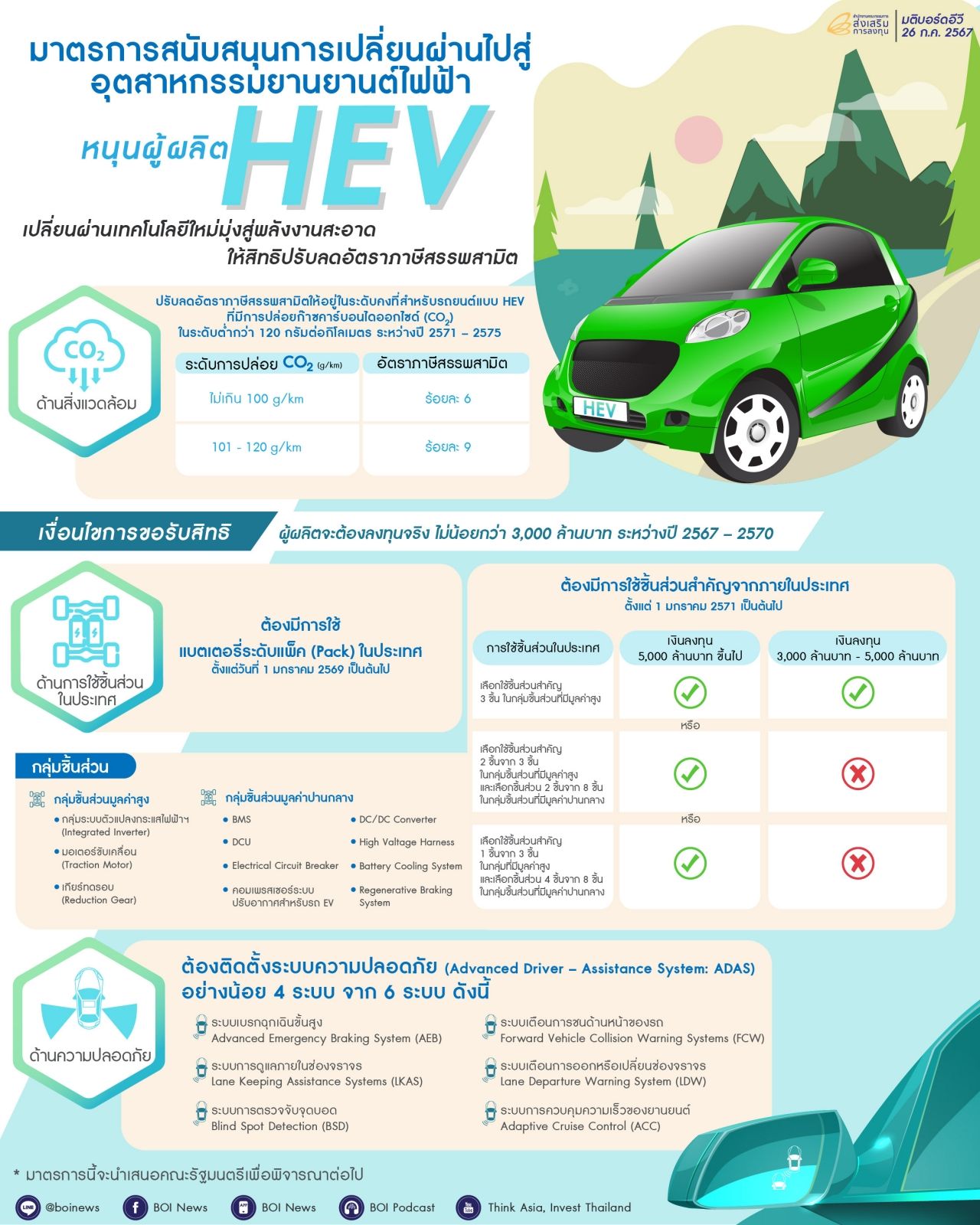

Reporters reported that the National Electric Vehicle Policy Committee or EV Committee meeting chaired by Mr. Pichai Chunhavajira, Deputy Prime Minister and Minister of Finance, approved measures to support the transition to electric vehicles. Reduction of excise tax rate on passenger vehicles. Hybrid or HEV type passenger vehicles with a passenger capacity of not more than 10 people.

By clarifying 4 important conditions: reducing carbon emissions; additional investment in the domestic production of key components and the installation of automotive safety systems to meet the needs of the people of the country to improve their quality of life. Entering a low-carbon society includes supporting continued investment in Thailand. Promoting Thailand to become a global production and export center for all types of electric vehicles.

Mr. Narit Therdsatheerasak, Secretary General of the Board of Investment, in his capacity as Secretary of the Electric Vehicle Committee, said that the measure is to increase the excise tax rate from the previous rate to a stable level between 2028 and 2032. A 2% payment will be made every two years to hybrid vehicle production companies that wish to obtain the rights. The following 4 conditions must be met before obtaining the rights:

1. Carbon dioxide (CO2) emissions must not exceed 120 grams per kilometer.

– Carbon dioxide emissions do not exceed 100 grams per kilometer, and the consumption tax rate is 6%.

– Carbon dioxide emissions 101-120 g/km, consumption tax rate 9%

2. Additional actual investment is required. Between 2024 and 2027, Thai automobile manufacturers and/or affiliated companies must invest no less than 3 billion baht.

3. The hybrid vehicle models applying for the rights must use important parts produced or assembled domestically. From 2026, they must use locally produced batteries, and from 2028, they must use other important parts, which are divided into 2 groups: 3 important high-value parts: traction motor, reduction gear, inverter.

The eight important components of medium value include BMS, DCU, pure electric vehicle air-conditioning compressor, circuit device, DC/DC converter, high-voltage wiring harness, battery cooling system, and regeneration system, depending on the investment value.

3.1 In case of additional investment of more than 5 billion baht You can choose to use 3 important items from the high value group, or choose 2 items from the high value group and 2 items from the medium value group, or if you choose 1 item from the high value group, you must choose 4 items from the high value group and the medium value group.

3.2 When the additional investment is more than 3 billion baht and less than 5 billion baht, only the three high-value portions can be used.

4. HEV models that apply for at least 4 of the following 6 systems must be equipped with an intelligent safety system (Advanced Driver Assistance System: ADAS).

– Advanced Emergency Braking (AEB)

– Forward Collision Warning (FCW)

– Lane Management System (LKAS)

– Lane Departure Warning (LDW)

– Blind Spot Detection (BSD)

– Vehicle Speed Control System (ACC)

“HEV or Hybrid Electric Vehicle is a market segment with high growth potential. It is produced for export and domestic distribution. Because it can solve the problem of energy saving. It helps to reduce dust and smog problems and greenhouse gases. It is also a technology that will help the transition to electric vehicles. The government recognizes the importance of the hybrid vehicle sector and therefore issued this measure. It is expected that at least 5 automobile manufacturers will be interested in participating, creating investment funds of no less than 50 billion baht in the next 4 years. It will also help increase the proportion of domestic parts used. Maintain and expand the base of Thai parts manufacturers and strengthen Thailand’s strength as a world-class integrated automobile production center.”

The meeting directed the Investment Committee, along with the Ministry of Finance, to submit the measure to the Cabinet for review and approval before making further announcements.

Mr. Narit said that this measure was introduced because the consumption tax rates used in 2026 will be very different. Between hybrid and BEV, since the tax rate for hybrid is gradually increasing, but BEV will remain unchanged at 2% for a long time, automakers may be worried about competition with very different tax rates. So, this is the origin of this measure. In order to be able to participate in the competition to build a production base with Thailand as the main production base and export to all over the world.

“It gives investors confidence that by bringing the measures forward, you can plan ahead and have confidence that between now and 2032 when the measures end, you will get the special tax rates and benefits of investing and producing parts in Thailand.”

Currently, there are 7 car companies that have been pushed by BOI to produce hybrid cars, 4 of which are Japanese companies and the rest are Chinese companies, these 7 companies may join this initiative. Or there may be new car manufacturers. You can also join this additional measure.

In addition, the meeting also recognized the results of the government’s measures to promote the development of the electric vehicle industry. The BOI has approved investment promotion for electric vehicle industry projects. Including the production of various types of pure electric vehicles, batteries and important components. Including charging stations. The total investment of the tax department’s EV3.0 and EV3.5 projects exceeds 80 billion baht. A total of 24 brands participated, representing a total of more than 118,000 vehicles of various types.

The number of pure electric vehicle registrations in 2024 is 37,679, a year-on-year increase of 19%. Among them, the number of registered electric motorcycles is 13,634, a year-on-year increase of 38%. Currently, the total number of pure electric vehicles registered in Thailand is 183,236.

[ad_2]

Source link