[ad_1]

Stock indexes are back near all-time highs, having recouped all losses since the beginning of the month, when markets were reeling from false alarms of an impending recession. It is now widely believed that the Federal Reserve will promptly respond to slightly weaker data on the labor market and begin lowering interest rates in September, which have been at their highest level in 23 years since July last year. The European Central Bank is also preparing to cut interest rates by a quarter percentage point next month. In theory, lower interest rates should encourage investment, thereby accelerating economic growth and increasing the attractiveness of risky investments in the stock market. The next big test will come on Wednesday, when Nvidia, a chipmaker with a sharp increase in profits and seen as a pioneer in the development of artificial intelligence, reports quarterly results. This year alone, Nvidia’s stock price has risen by nearly 170%! Clearly, Nvidia needs to satisfy its voracious appetite, otherwise it will mean a big drop in its stock price. The release of quarterly results has become as important an event in the sports world as the Super Bowl.

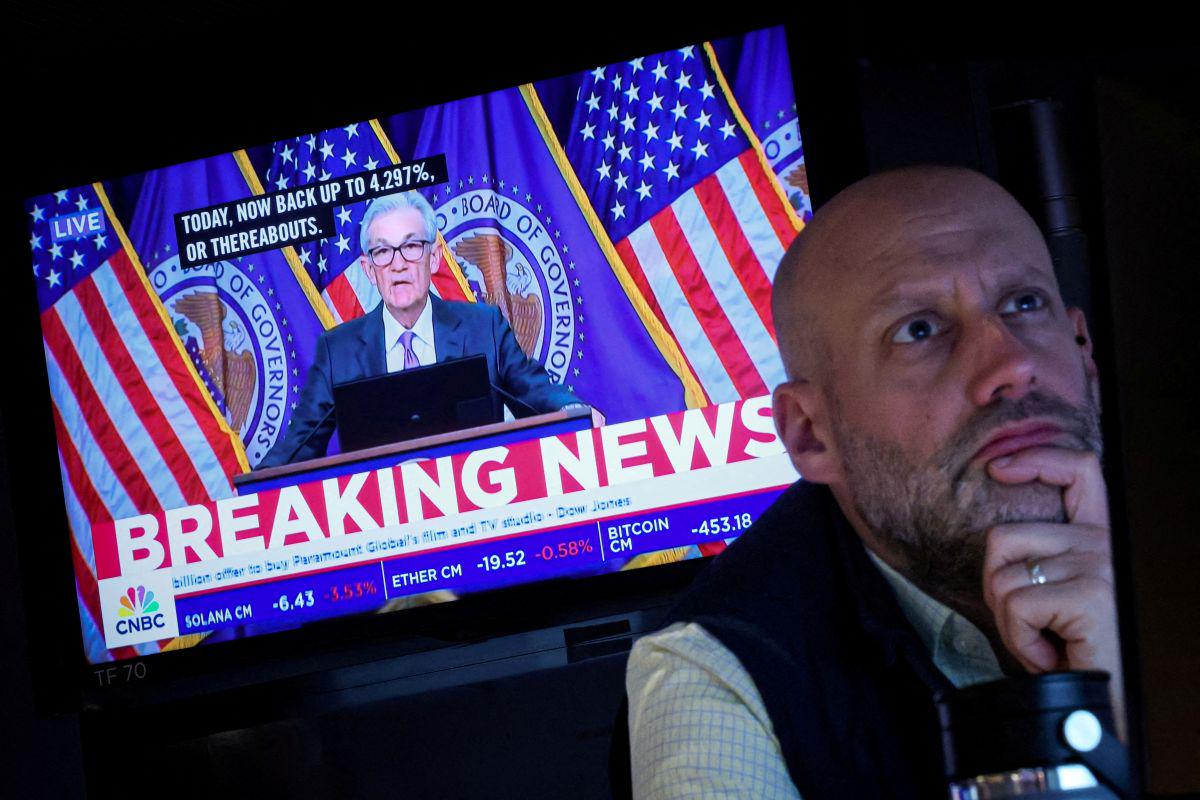

The time has come, the facts are the facts *

At the routine annual symposium for central bankers in the idyllic Jackson Hole, Jerome Powell confirmed the view of most financial markets that monetary policy must change. The fight against inflation has been fairly successful (PCE index was 2.6% on an annual basis in June), so the Fed must now focus more on its second task, maintaining near full employment. “The time has come for the U.S. to start cutting interest rates. The risks of higher inflation have fallen, but the risks of a deterioration in labor market conditions have increased.” Powell announced. Therefore, at the next meeting (September 17-18), it is almost certain that the federal funds rate will be reduced by 25 or even 50 basis points.

The interest at the end of the year is four percent?

“The capital markets have finally seen the decision of the Federal Reserve to put an end to more than four years of restrictive monetary policy, since, as announced by Jerome Powell, there is no longer any reason to keep interest rates at their current level. The reason for the decline in interest rates is mainly the cooling of the labor market, which has had a significant impact on price growth in the economy over the past period. As a result, prices of all investment categories have risen. More important for further trends will be the magnitude of the interest rate cuts by the Federal Reserve this year. A decrease of 125 basis points is expected. Analysts expect the base rate to be four percent by the end of the year. In addition to macroeconomic indicators, the short-term trend will be largely influenced by the announcement of Nvidia’s quarterly results, which has been the driving force behind the bullish trend and general optimism in the UI sector over the past year. The results, to be announced after the close of trading on August 28, could reverse the situation or extend the bull market,Branko Železnik (BLK Finance) tells us.

Gold hits all-time high, Bitcoin recovers sharply

Last week (mainly at the expense of Friday’s highs), the three main New York stock indexes rose by almost half a percent. Other investment categories reacted as expected to Powell’s “promise” that the Fed will start a rate cut cycle. Bond prices rose, and required yields fell. Oil prices rose on Friday, but could not avoid weekly losses. Gold prices closed the week above $2,500 an ounce after hitting a new all-time high of $2,531 on Tuesday. The dollar continued its sharp decline, falling to its lowest level in 13 months against the euro. Bitcoin achieved strong weekly growth, and its price ($64,500) is already nearly 30% higher than on August 5. Inflows into US ETFs on the spot price of Bitcoin remain enviable – a total of $17.5 billion this year.

| Last week’s trend | |

| Dow Jones (New York) |

41,175 points (+1.3%) |

| S&P 500 Index (New York) | 5,634 points (+1.4%) |

| NASDAQ (New York) | 17,877 points (+1.4%) |

| STOXX 600 (Europe) | 518 points (+1.3%) |

| DAX (Frankfurt) |

18,633 points (+1.7%) |

| Nikkei Index (Tokyo) | 38,330 points (+1.8%) |

| SBITOP (Ljubljana) | 1,602 points (+0.6%) |

| Slovenia 10-Year Bond | Required return: 2.96% |

| 10-year US bond | Required return: 3.80% |

| US Dollar Index | 100.7 points (-1.7%) |

| EUR/USD | 1,1192 (+1,5%) |

| EUR/CHF |

0.9488 (-0.6%) |

| Bitcoin |

$64,200 (+8.0%) |

| NAFTA Brent Crude Oil | $79.0 (-0.8%) |

| Gold | $2.512 (+0.2%) |

| Euro Interbank Offered Rate (six months; three months) | 3,408%; 3,541% |

Will an election year affect Wall Street?

As this is an election year in the US, trading dynamics are also influenced by the results of the polls, although it seems irrelevant whether Kamala Harris or Donald Trump will win in the end. Bank of America’s monthly survey of fund managers showed that insiders are more worried about a possible recession and geopolitical tensions than the election results, although they pointed to the danger of the same party controlling both the White House and Congress as one of the risks. Throughout the past two terms, the S&P 500 has followed a similar pattern: a decline before the election and an immediate rise after the election. In 2020, with Joe Biden’s victory, the S&P fell in the two months before the election, and then rose 10% in November, also due to progress in the development of the new crown vaccine. Interestingly, energy company stocks have performed better under Biden than Trump, despite Trump being more sympathetic to the fossil fuel industry. On the other hand, green energy stocks have risen more under Trump than during Biden’s term, even though he has passed a massive plan to promote green energy.

* – The time has come and the truth is the truth (part of the lyrics from the 80s hit song Beds Are Burning).

[ad_2]

Source link