[ad_1]

(Edaily reporters Song Friday and Choi Jung-hee) “It was provided through legal procedures based on the entrustment relationship with Alipay.” (Kakao Pay) “Provided more information than necessary without the customer’s consent.” (Financial Supervisory Service)

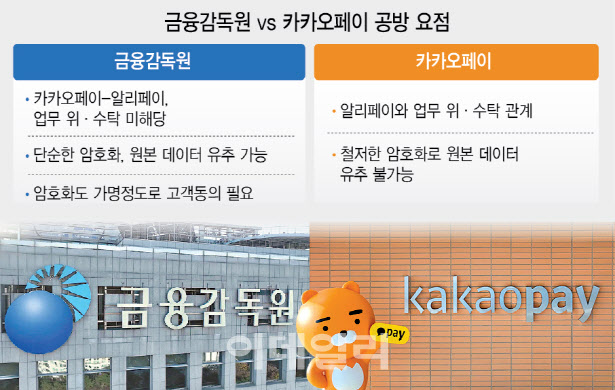

The Financial Supervisory Service and Kakao Pay have been engaged in a fierce war of words over whether the customer information that Kakao Pay handed over to Alipay was illegal. The Financial Supervisory Service and Kakao Pay released news references and statements on the 13th, respectively, to defend each other’s legitimacy. The Financial Supervisory Service focused on the illegal elements in the customer information that Kakao Pay provided to Alipay. The Financial Supervisory Service pointed out that Kakao Pay provided Alipay with all customer credit information, including customers who do not use overseas payments.

|

Since April 2018, a total of 54.2 billion cases (40.45 million people) have been registered. The information provided includes Kakao account ID, mobile phone number, email, Kakao Pay subscription details, and transaction details. In addition, it was pointed out that Kakao Pay did not need to provide information such as customer credit information when settling overseas payment amounts to Alipay, but provided Alipay with the credit information of overseas payment users. From November 2019 to date, Kakao account ID, order information, and payment information are provided every time an overseas payment is made. As of now, a total of 550 million cases have been provided. Kakao Pay directly refuted the Financial Supervisory Service’s remarks. Kakao Pay claimed that this was Apple’s request. Kakao Pay said, “Unlike other overseas merchants, Apple’s App Store requires a higher level of fraud prevention processes, and Apple has long had a partnership with Alipay,” adding that “Apple uses Kakao Pay as a payment method for the App Store. When adopting, we recommend the use of the Alipay system.” He emphasized, “No illegal information was provided.” “The explanation is that it is handled in accordance with the business entrustment relationship between “Kakao Pay-Alipay-Apple”. According to the Credit Information Law, when entrusting personal credit information processing to transfer information, it is not necessary to obtain the consent of the information subject. In other words, user consent is not required. Kakao Pay stated that because customer information is transmitted in encrypted form, it cannot be used for purposes other than verifying fraudulent payments.

Kakao Pay said that “Ant Group, to which Alipay belongs, is an independent company from the e-commerce platform Alibaba Group” and that “the claim that Kakao Pay customer information was transferred to China’s largest business affiliate without consent is absurd.”

The Financial Supervisory Service refuted Kakao Pay’s claims. The Financial Supervisory Service found that Kakao Pay and Alipay did not sign a commission contract for the work of calculating NFS (customer-specific credit score required when operating Apple’s one-time payment system) scores and providing them to Apple, and that this was a commission for me to decide not to do credit information processing. Alipay should have handled the matter under the management and supervision of Kakao Pay and had no independent interests other than the fees for handling the commissioned work, but this was not the case.

In addition, he pointed out that Kakao Pay’s encryption level is low, so even the general public can decrypt it using a publicly available encryption program. Therefore, we emphasize that this information is pseudonymous information under relevant laws, so customer consent is required. Even if complex encryption is used, customer consent is required because it is pseudonymous information. The HKMA said it will swiftly impose sanctions on Kakao Pay. A person related to the Financial Supervisory Service said, “We will quickly initiate sanctions procedures after a thorough legal review and check whether there are similar cases.”

|

[ad_2]

Source link