[ad_1]

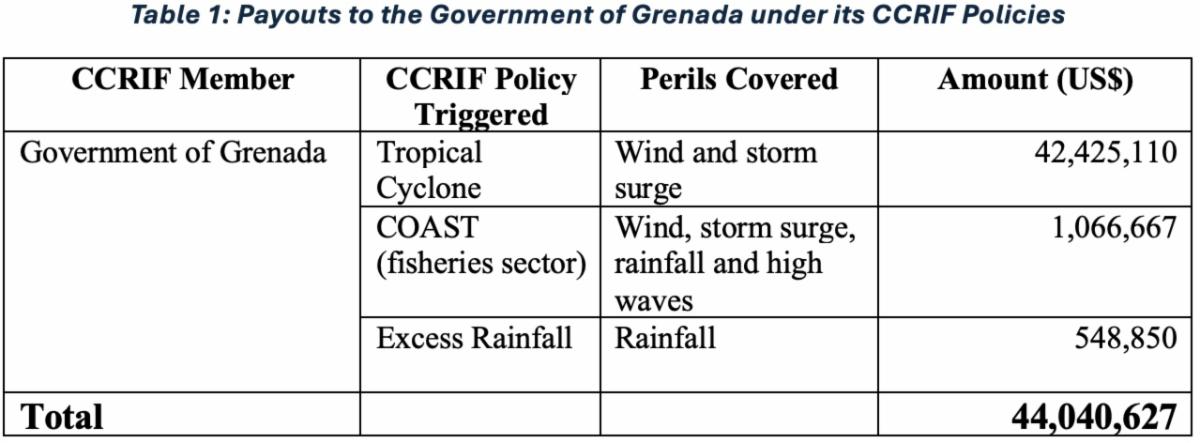

(Press Release) GRAND CAYMAN, Cayman Islands, July 10, 2024. This week, CCRIF will pay compensation totaling approximately US$44 million (ECD 118 million) to the Government of Grenada following the destruction of 90% of buildings (including airports, marinas, petrol stations, hospitals and residences) on Grenada’s two sister islands, Carriacou and Petite Martinique.

The agricultural sector and the natural environment, including mangrove ecosystems, also suffered severe damage. Electrical infrastructure, mainly the transmission and distribution systems on both islands, also suffered severe damage. The northern part of mainland Grenada was not spared by Hurricane Beryl, which damaged homes, the agricultural and forestry sectors, and the electrical transmission and distribution and water systems.

The CCRIF Board and Management express their deepest condolences to the Government and people of Grenada for the loss of life, property and livelihoods as a result of this severe storm. CCRIF is very aware of the impact on other CCRIF member countries in the region and extends its condolences to St. Vincent and the Grenadines and Jamaica for the loss of life in those countries.

|

|

CCRIF’s parametric insurance policies pay out based on the intensity of events and the amount of losses caused by those events, calculated according to a pre-agreed model. Grenada’s tropical cyclone (TC) insurance payout was the largest payout paid by CCRIF. Haiti was CCRIF’s largest payout so far, receiving nearly $40 million following the 2021 earthquake.

CCRIF currently offers six parametric insurance products covering tropical cyclones, excess rainfall, earthquakes, and the fisheries, power and water sectors. Isaac Anthony, CEO of CCRIF, said: “These payouts are the first that Grenada has ever received from CCRIF. I commend the Government of Grenada for maintaining, despite not receiving payouts, that it understands the importance of financially protecting its economy when disaster strikes, as it does not want a repeat of Hurricane Ivan.”

Speaking further about Beryl, Mr. Anthony stated: “Countries should treat parametric insurance for natural disasters like health insurance. We buy health insurance because it is important to protect our lives. However, we hope that we do not need it, but when we do, we can rest assured that it can help us cope with illnesses more serious than the common cold. Similarly, we do not want to be negatively impacted by and face natural disasters. However, in the case of CCRIF’s parametric insurance, when we do need it, it is available within 14 days of the triggering event. CCRIF’s parametric insurance must be seen as a key component in helping countries build back better and stronger to withstand future natural disasters, especially in the context of climate change”.

Hurricane Beryl seems to recall Hurricane Ivan, which struck nine Caribbean islands 20 years ago. Beryl hit the same number of countries, causing massive damage along the way. The impact of Hurricane Ivan in 2004 made Caribbean governments pay close attention to the need for rapid liquidity after natural disasters – before even thinking about reconstruction and redevelopment. Hurricane Ivan was the catalyst for CCRIF and the introduction of parametric insurance in the Caribbean. Hurricane Ivan in 2004 caused economic losses to Grenada and the Cayman Islands totaling 200% of their annual GDP, with seven other countries also severely affected. Regional losses from Ivan totaled more than $6 billion.

However, there are several important differences today compared to 2004. Countries such as Grenada, St. Vincent and the Grenadines, and Jamaica can now access liquidity from CCRIF within 14 days of the impact of Hurricane Beryl to begin recovery efforts.

Parametric insurance is not debt relief and does not increase a country’s debt stock. CCRIF has demonstrated that catastrophe risk insurance can be effective in providing a level of financial protection to countries vulnerable to natural disasters. Parametric insurance products are an important component of national Disaster Risk Financing (DRF) strategies and are designed to pre-finance short-term liquidity. CCRIF’s parametric insurance helps close protection gaps, reduces budget volatility, and enables countries to respond quickly to the most pressing needs, including supporting the most vulnerable in their populations.

Prior to Beryl, CCRIF had made 65 payments totaling $274 million to 17 members since its inception in 2007. CCRIF expects to make 10 payments totaling more than $75 million under Beryl in the coming days, bringing total payments to approximately $350 million.

The government of St. Vincent and the Grenadines will receive $1.8 million and the government of Trinidad and Tobago will receive $372,752 to cover the impact of Beryl on Tobago. Jamaica will also receive payments, which will be announced later this week. Insurance can be purchased from CCRIF up to $150 million, with a per-disaster payout limit of $150 million. CCRIF has never established a facility to insure all local losses. So while these payments may not cover all reconstruction costs, all recipient governments are grateful for the rapid injection of liquidity, which they are using to address immediate priorities.

Twenty years after Hurricane Ivan, the Caribbean remains at high risk due to the increasing severity, frequency, unpredictability and variability of hydrometeorological hazards such as storms, rainfall, drought and heat, which are exacerbated by climate change, in addition to earthquakes and other seismic hazards. Countries in the region continue to strengthen their resilience to disasters and engage in comprehensive disaster risk management. But importantly, the Caribbean and Central America are now financially protected from the impacts of these hazards, not only through CCRIF and its parametric insurance, but also through the use of a variety of disaster risk financing instruments. CCRIF continues to engage in dialogue with its members on the importance of establishing a suite of DRF instruments that can address the full range of hazards facing countries in the region and anticipate emerging risks.

[ad_2]

Source link