[ad_1]

Tony Anderson

About Pitney Bowes

Pitney BowesNew York Stock Exchange:Polyphenylene isobutylene) has a long history, but its recent history is not encouraging. The 104-year-old company provides business services such as mailing equipment, software, e-commerce technology and shipping services. The company even has its own bank, which reflects the diversity of the services it provides.

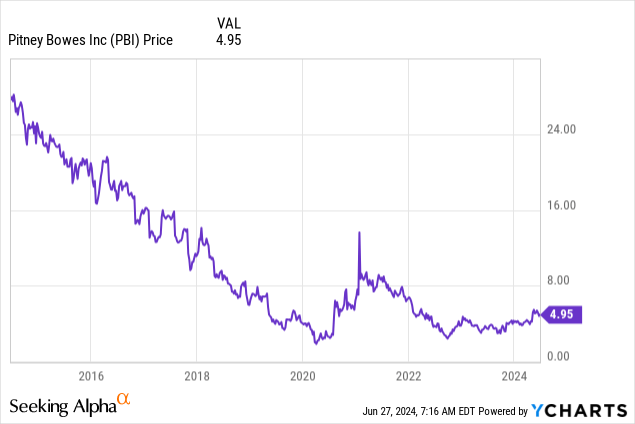

Stock price performance (poor)

The company has been on a downward spiral since peaking at around $66 a share in 1998. Over the past decade, its market value has fallen below $1 billion.

(Pitney Bowes 10-year return)

Eventually, though, there is hope for the company to rise again. Hestia Capital (founded by Kurt Wolf, who was also deeply involved in the GameStop saga) is interested in completely transforming the company. It has made its bet, and it seems to be winning, as Hestia Capital Now has control of the board, a deal has been struck, and their preferred CEO is in power. You can find many articles on the Hestia proxy fight here on Seeking Alpha and elsewhere, so I’ll let bygones be bygones. Let’s focus on what this means for the company in the near future.

Pitney Bowes Current Structure

During its most recent earnings call on May 2, the company’s financials were broken down into three distinct business segments:

SendTech

-

SendTech Solutions provides physical and digital mailing and shipping technology solutions, financing, services, supplies and other applications to clients of all sizes to help simplify and save money on sending, tracking and receiving letters, packages and snail mail

Pre-classification

- Presort Services provides sorting services that qualify customers for USPS Work Share discounts on First Class Mail, Marketing Mail, First Class Marketing Mail, and Bound Printing

Global e-commerce

-

Global Ecommerce provides business-to-consumer logistics services for domestic and cross-border deliveries, returns, and fulfillment.

First, the following points are obvious:

Two of the three divisions are profitable and growing both Adjusted EBITDA and Adjusted EBITDA (more on that later). One division, despite all its efforts, is clearly not profitable.

Let’s look at each part one by one.

SendTech Business Units

The SendTech business unit is the largest segment in terms of revenue and profit. Revenues were down slightly in the first quarter (2%), but adjusted EBITDA was up 6% year-over-year. This was primarily due to savings in COGS and SG&A.

In January this year, the Digital Express Service was transferred from the Global eCommerce division to the SendTech division. This enhanced the service.

The SendTech business is what Pitney Bowes calls a “high-margin, recurring revenue business.” At first glance, it might look like a division that’s neither growing nor declining, but in reality, if you dig deeper into the numbers, you’ll find a story of two different trends.

New SaaS digital products are growing strongly (40% YoY), while the more traditional physical meter business is declining (-4% YoY). Although the SaaS business only accounts for 15% of the division’s total revenue ($200 million of $1.3 billion), it’s still encouraging to see this growth hidden in the belly of the behemoth. Every additional dollar of growth from this product is potentially more profitable, so let’s welcome this evolution.

Pitney Bowes has launched its ParcelPoint smart locker product in recent years, which should not be underestimated. This is a booming market in Europe, and there is a possibility that this trend will also affect the United States. If so, they can quickly take advantage of this. InPost, a Polish listed company that only does parcel lockers, has a market value of 8 billion euros, annual revenue of 2 billion euros, and an adjusted EBITDA margin of 30%. This valuation is justified because the company is still growing rapidly.

Pre-sorting business department

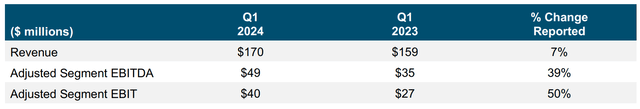

The Presort business is not an exciting one in my opinion. It is smaller than SendTech in both revenue and adjusted EBITDA ($170 million and $49 million, respectively, in the first quarter of this year), and the secular decline in physical mail will, in my opinion, become a bigger pain point in the coming years. As the previous CEO (Jason Dies) explained on the earnings call, mail volume has been declining by about 6% to 8% per year. This trend is likely to continue or even accelerate. Impressively, Presort’s mail volume was down only 2% in the first quarter of this year, and the company even grew revenue by 7% year-over-year due to increased piece-rate revenue. Additional process improvements and cost-saving initiatives even led to a 39% year-over-year increase in adjusted EBITDA. If a recession were to occur, the Presort business would also be hit hard.

Global e-commerce business unit

You might be thinking, so far so good. How could this stock drop 80% in 10 years when you painted such a rosy picture? Well, a lot happened. Suffice it to say, there was too much trading in the business and strategic errors were made.

The Global E-Commerce division is a living proof of this. GEC (Global E-Commerce) was formerly a company called Newgistics, which Pitney Bowes acquired for $475 million in 2017. This number is shocking when you consider that Pitney Bowes is currently valued at just under double that.

Not only has the GEC division never been profitable, it has forced the company to make capital expenditures with the constant promise that scale will eventually make the business profitable. Hestia explicitly calls this a strategic mistake. The GEC business is currently under strategic review, which has accelerated since the arrival of new CEO Mr. Rosenzweig. More on this later.

In the first quarter of this year, the GEC unit had revenue of $333 million, comparable to SendTech, but its gross margin was only $3 million, or 1%.

In 2023, it contributed $78 million of negative adjusted EBITDA to the company’s finances. Taking into account the high investments in the past, the adjusted EBIT even amounted to $136 million. Revenues have been falling for several years, and economies of scale have not yet been achieved. Perhaps the GEC unit was very useful as part of a larger organization, but for Pitney Bowes, now it is clear to everyone that they will deal with it by selling it or closing it.

Hestia’s Turnaround Plan: Mr. Rosenzweig Appears

This brings us to the new plan proposed by Hestia and executed by CEO Mr. Rosenzweig. From their May 22 press release:

These initiatives include:

Cost Rationalization – Building on previously announced efficiency measures totaling approximately $85 million, Pitney Bowes has retained a nationally recognized consultant to support a cost rationalization review. Preliminary analysis found potential annual savings of $60 million to $100 million across the organization, excluding the Global Electronic Commerce (“GEC”) business.

GEC Accelerated Review – Pitney Bowes is working to expedite the completion of its strategic review of the division. Board members with extensive transactional experience are increasing their involvement in the review to drive near-term completion with the goal of enhancing shareholder value.

Cash Optimization – Pitney Bowes is working to reduce its future cash requirements by approximately $200 million. The Company intends to achieve this through improved liquidity forecasting and management at all levels, actions on the GEC, and optimization of the balance sheet of Pitney Bowes Bank (the “Bank”). In addition to freeing up cash for the Company, the Bank optimization effort will also improve its return on equity.

Balance Sheet Deleveraging – Pitney Bowes is taking the necessary steps to realize the benefits of the three initiatives outlined above. In the short term, leadership intends to reduce leverage on the business’ balance sheet and prioritize the repayment of high-cost debt.

However, since writing this article, another press release has come into the market and I have had to modify some of the cost savings content to make it even more significant savings! Let’s try to figure out what this means for Pitney Bowes.

-

Additional cost reductions of approximately $140 million per year were determined (the average of the range provided, up from the $80 million previously determined).

-

GEC will be sold. This will immediately improve profitability by $136 million in adjusted EBITDA and save $30 million in annual capital expenditures.

-

They will free up $200 million in cash.

All of the above funds will be used to pay down debt and reduce the leverage of the balance sheet. Note that the interest expense is a whopping $164 million per year.

If all of the above are achieved, the new PBI will be:

-

Annual revenue of approximately $2 billion

-

Earn approximately 50% or $1 billion in gross profit

-

EBIT margin of approximately 26%, or $520 million

-

Payment of approximately $70 million of unallocated corporate expenses (after deducting $140 million of costs)

So that means a final adjusted EBITDA of $450 million. Of course, with the $164 million in interest expense, that leaves only about $286 million in profit. If you multiply the EV/E by 13, the enterprise value comes to $3.7 billion.

With these savings, they can buy back almost all of their March 2028 bonds ($274 million) that pay 11%. This would instantly add about $30 million per year to their profits with no execution risk. This could snowball as they pay down their debt.

The risks of the paper

The biggest risk to this thesis is a severe recession. History shows that when recessions hit, the postal industry is hit particularly hard. Currently, the heavily indebted company cannot survive difficult times.

Another risk, of course, is that the sale of the GEC business fails completely, or experiences very high one-time costs, which spooks the market. The investment thesis relies heavily on the fact that GEC should be shut down, and that the market simply does not price these opportunities correctly.

Investment Summary

All in all, I think the margin of safety is high enough to buy in. If management delivers on its promises and the economy continues to boom, the company should be making around $300 million in annual profits 12 months from now, with many excellent growth opportunities ahead.

The current (July 7, 2024) market capitalization and enterprise value of Pitney Bowes are (based on Yahoo Finance):

- Market value: $1.14 billion

- Enterprise value: $3.07 billion

I can safely assume that an EV/E of anywhere between 12 and 14 is justified, depending on the level of excitement about these opportunities. At the midpoint of 13, we get an enterprise value of $3.9 billion. By that time, at least $300 million of debt should have been repaid due to increased profits and freed-up cash in the Pitney Bowes bank, which also helps the final valuation. This would result in:

- Market value: $2.27 billion

- Enterprise value: $3.9 billion

That’s almost double today’s price, at $12.60 per share.

[ad_2]

Source link