[ad_1]

After the recent sell-off on Wall Street, which was also mirrored in Europe and Asia, markets appear to be gradually recovering. While concerns about a U.S. recession remain, they have eased somewhat. Now, to be sure, we are talking about a lifetime dream annual rate, with some experts predicting even more this year. These outlooks were supported by the country’s latest macroeconomic data, which showed falling inflation and strong retail sales. Has the world’s largest economy avoided the worst? (1)

Gradual rate cuts more likely

US stocks moved higher on Thursday after the fall in US inflation to 2.9% and not to 3% as I had expected. On Friday, August 23, the Chairman of the Federal Reserve should give a speech at the central bank’s annual symposium, but Jerome Powell is not expected to confirm the end of the interest rate dream. Instead, analysts are now working on a version in which the central bank could gradually cut interest rates by 0.25% for t consecutive months (i.e. in January and November). After the recent massive sell-off of Wall Street stocks, which led to a sharp drop in their value, they began to hear rumors of a lifeless annual interest rate of 0.5%. However, it now seems that investments may be concentrated on the rise in unemployment, which in itself does not necessarily mean the beginning of a recession. (2)

Recession fears are fading

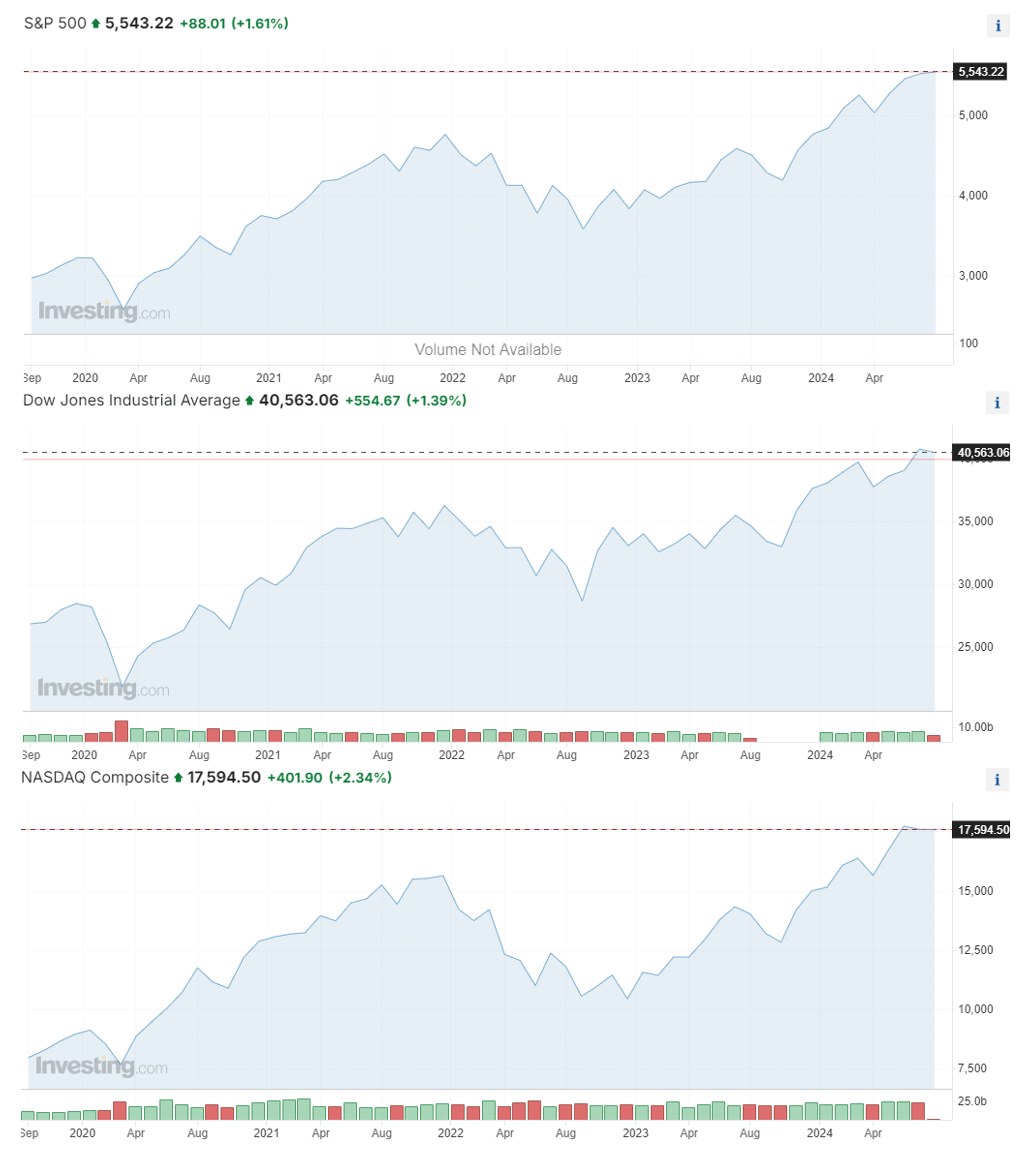

Over the past week, the US stock market has managed to erase a lot of its previous losses, thanks not only to the lack of inflation expectations, but also to good economic performance of some key companies in various industries, especially retail. In particular, the quarterly results of large retailers Walmart and Home Depot exceeded the average analyst forecast, indicating that consumer activity in the industry remains strong despite falling inflation and rising unemployment. This was evidenced by the quarterly data on US retail demand, which increased by 1% month-on-month, while the market generally expected 0.4%. The US benchmark S&P 500, Dow Jones Industrial Average and Nasdaq Composite all narrowed their gains on Thursday, rising 1.6%, 1.4% and 2.3% respectively. * For the S&P and Nasdaq indices, it was the eighth consecutive day of gains. *

Source: Investing.com*

European markets had a mediocre week

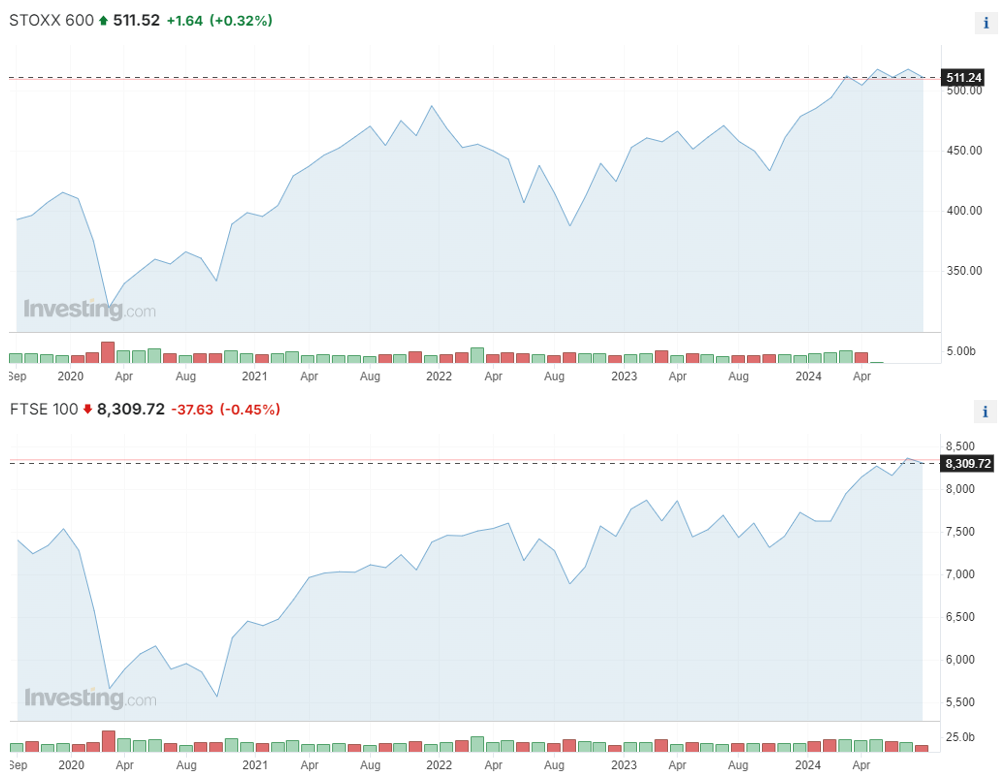

There was a positive mood in the European markets, especially in technology stocks such as ASML Holding and ASM International. Firstly, technology stocks tend to be the most sensitive to annual interest rates, and the recent stock market decline has hit them the hardest. It is dominated by the retail, automotive and banking sectors. However, multiple market segments were affected, and the European Stoxx Europe 600 index rose 1.15% on the fourth trading day, which was its fourth day of gains, and last week also marked its best week since the beginning of May. The UK’s FTSE 100 index was flat this week. * The UK released retail sales data, which increased by 0.5% month-on-month, leading to a slowdown in economic growth, when the initial estimate of GDP growth in the second quarter was 0.6%, compared with 0.7% in the same period last year in the first quarter. All these indicators were in line with analysts’ forecasts.

Source: Investing.com*

Japanese stocks lead gains in Asia

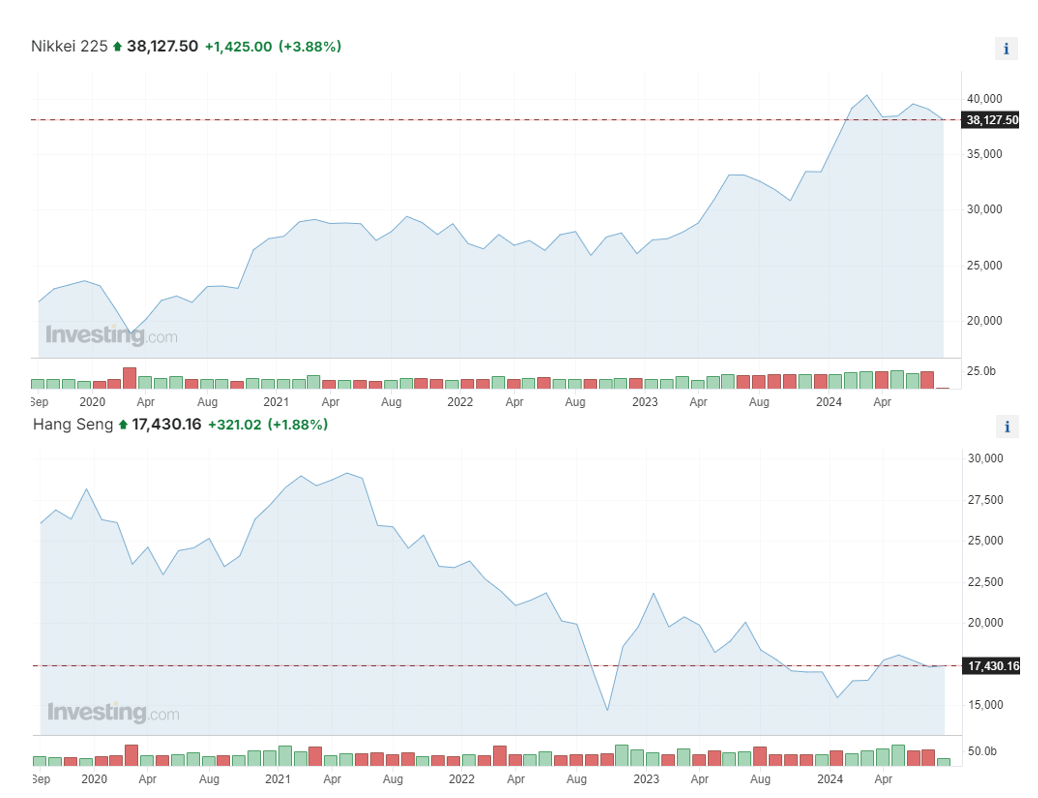

Asia was not far behind, with Japan’s main index Nikkei 225 hitting a new high after a historic decline in the previous period, closing with a profit of 3.88%, up 8% for the week, the best performance since April 2020. The Nikkei and Hong Kong stocks, the Hang Seng Index, rose 1.91% this week, largely due to the excellent quarterly results released by JD.com, a Dutch retail giant traded on the Hong Kong Stock Exchange. * In contrast, the results of rival Alibaba were disappointing. However, the company pointed to a slowdown in consumer spending in the domestic market. The evidence is the latest female retail sales data, which, although up 2.7% year-on-year, exceeded expectations, the growth trend since November 2023 shows a slowdown in growth.

Source: Investing.com*

Zivl

Overall, it can be said that the market is stabilizing after the recent decline, and economic indicators are showing an optimistic trend. Although fears of a recession are fading, interest rates are gradually falling, which may support further growth. This positive sentiment is reflected not only in the United States, but also in European and Asian markets, where stock markets have recorded significant gains. Although risks remain, recent days have shown that the global economy can avoid the worst. (3)

David Matulay, InvestingFox

resource:

https://www.investing.com/news/economy-news/powell-to-lay-out-case-for-orderly-september-rate-cut-at-jackson-hole-next-week-3574624

https://www.investing.com/news/stock-market-news/stock-market-today-sp-500-extends-writing-streak-on-signs-of-economic-strength-3572837

https://www.investing.com/news/economy-news/european-shares-tick-up-on-fed-cut-bets-3573000

https://www.investing.com/news/economy-news/uk-economy-expands-as-forecast-in-q2-3572968

https://tradingeconomics.com/united-kingdom/retail-sales

https://www.investing.com/news/stock-market-news/asian-stocks-rise-tracking-wall-st-rally-as-recession-fears-ease-3574838

https://tradingeconomics.com/china/retail-sales-annual

* Past data does not guarantee future results.

(1), (2), (3) Insights generally represent assumptions and current estimates that may not be accurate or are based on the current economic environment and are subject to change. These insights are not future performance indicators. Forward-looking statements inherently involve risks and uncertainties because they relate to future events and circumstances that are not predictable and actual developments and results could differ materially from those expressed or implied in any forward-looking statement.

WARNING! This marketing material is not and should not be considered investment advice. Past performance data is not a guarantee of future performance. Investing in foreign currencies may have an impact on income due to currency fluctuations. All valuable Chili trading may result in profits and losses. Insights often represent assumptions and current forecasts, which may not be accurate or based on the current economic environment, which may change. These insights are not future performance skills. InvestingFox is a trademark of CAPITAL MARKETS, OCP, regulated by the National Bank of Slovakia.

David Matule

David Matulay is an InvestingFox analyst. He joined the company in 2023 as Head of Trading and Portfolio Manager. Prior to that, he gained many years of experience as a financial analyst at Advena Hedge Fund.

David studied Industrial Informatics at SP Elektrotechnick in Bratislava and Finance, Banking and Investments at the University of Economics in Bratislava. He is currently studying International and Diplomatic Studies at the Institute of International and Public Relations in Prague.

Invest in Fox

InvestingFox is a registered trademark of CAPITAL MARKETS, ocp, as, a company that is a securities dealer according to the decision of the National Bank of Slovakia. OPK-2297/2007-PLP. With 16 years of experience in financial markets, it offers a solid foundation for partners.

Our experts offer high expertise and first-class service, with the ability to trade over 1,000 trading instruments through CFD derivatives. With us, you can be sure that personal data, deposits and withdrawals are protected by documented cybersecurity standards.

More information: https://investingfox.com/.

[ad_2]

Source link