[ad_1]

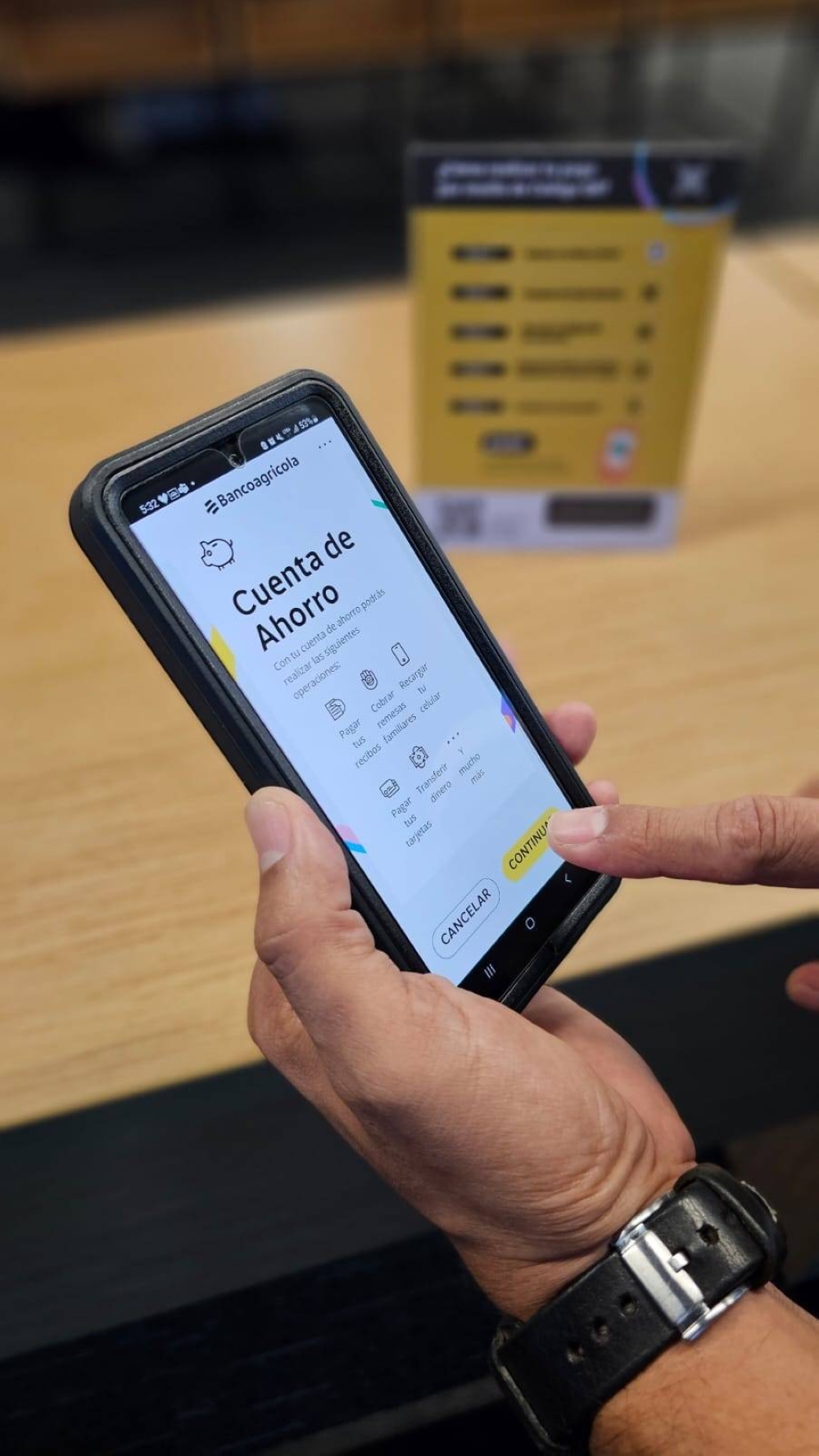

Open a savings account simply through the DUI, without any formalities or queues, without NIT or initial amount, and you can do it in the palm of your hand with the Bancoagrícola digital account, a digital savings account for those who are looking for agility, practicality and easy control of your funds.

With digital accounts, people can receive their wages, send money, pay for services and top up their phones. They can also use Transfer 365 to transfer money instantly between banks and withdraw cash at Bancoagrícola ATMs and financial communication banks. In addition, shopping in stores with QR codes is faster.

As a bank for Salvadorans, this financial institution offers innovative solutions tailored to their needs, with the goal of promoting financial inclusion through products that make it easier for them to manage their money and that can be accessed from anywhere through the bank’s mobile application, contributing to the sustainable development of the country.

In the first half of 2024, Bancoagrícola opened more than 148,000 new savings accounts; 48% of these accounts were opened by women. Significantly, more than 45,000 of these procedures were carried out through digital channels.

As of June 2024, the bank has more than 1.9 million active savings accounts, 51% of which belong to women.

As of June 2024, the bank has more than 1.9 million active savings accounts, 51% of which belong to women.

“We listen to our customers to provide them with solutions that suit their needs and offer them a better experience; therefore, we continuously enhance and innovate our products and services. With digital accounts, we make everything simpler, more flexible and more reliable, thereby promoting financial inclusion and a culture of savings.” commented Rafael Barraza, Executive President of Agricultural Bank.

This has resulted in 38% of its 1.6 million customers becoming digital assets, representing more than 600,000 people. This means that the bank is able to reach more Salvadorans, continue to increase inclusion and achieve its goals with the support of digital channels.

Likewise, financial institutions work and invest in the security of their systems with the goal of maintaining their customers’ trust and giving them peace of mind.

Agricultural Bank promotes sustainable development for the benefit of all by creating solutions that facilitate access to financial products and promote a culture of savings.

[ad_2]

Source link