[ad_1]

The latest data from Boston University’s Global Development Policy Center shows that Chinese banks approved loans worth $4.61 billion to Africa in 2023, the first annual increase since 2016.

Thanks to President Xi Jinping’s Belt and Road Initiative, Africa received more than $10 billion in loans from China each year between 2012 and 2018, but lending has fallen sharply since the start of the COVID-19 pandemic in 2020.

Research from Boston University’s Global Development Policy Center found that last year’s figure was more than three times higher than in 2022, suggesting China’s interest in reducing the risks associated with a highly indebted economy.

“Beijing appears to be seeking more sustainable loan balance levels and trying out (new) strategies,” said the university’s center, which manages the China Africa Loans Database project.

The new data comes as Beijing prepares to welcome African leaders next week for the triennial Forum on Africa-China Cooperation (FOCAC).

The study showed that last year there were 13 loan agreements involving eight African countries and two African multilateral creditors, including Angola, Egypt and Nigeria.

The largest projects last year included a nearly $1 billion loan from China Development Bank for the Kaduna-Kano railway project in Nigeria, a similar-sized credit line to Egypt’s central bank and a $249 million loan to Angola.

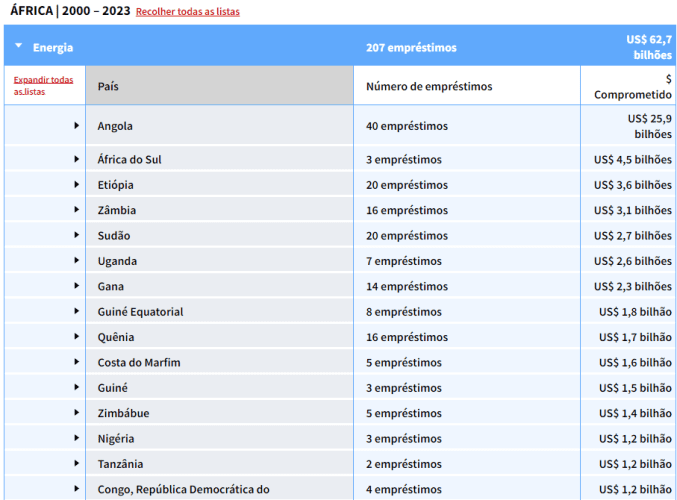

China has become the largest bilateral creditor of many African countries, and Angola is by far the country that has benefited the most from Chinese loans.

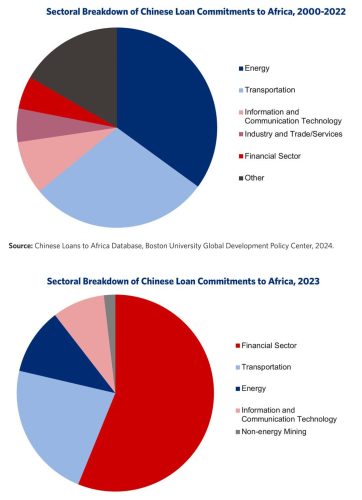

According to research from Boston University, China provided a total of $182.28 billion in loans to the African continent between 2000 and 2023, with most of the resources going to Africa’s energy, transportation and information and communications technology sectors. The table below lists the 15 main beneficiaries of Chinese loans, highlighting the importance of Angola, which ranked first. Angola received $25.9 billion, accounting for 14.3%, while South Africa, ranked second, received only $4.5 billion, accounting for 2.5%.

Africa played an important role in the early days of the Belt and Road Initiative, as China sought to recreate the ancient Silk Road and expand its geopolitical and economic influence by promoting infrastructure development around the world.

However, China began turning off its funding spigots in 2018, a shift accelerated by the pandemic, leaving many projects in the region unfinished, including a modern railway designed to connect Kenya with its neighbors.

The reduction in lending is due to China’s own domestic pressures and rising debt burdens in African economies. Zambia, Ghana and Ethiopia have been under extended debt review since 2021.

More than half of the loans pledged last year, or $2.59 billion, went to regional and national lenders, according to the Boston University study, reinforcing Beijing’s new strategy.

“Chinese banks’ focus on African financial institutions may represent a risk mitigation strategy to shield African countries from debt challenges,” the study said.

Nearly a tenth of the 2023 loans went to three solar and hydropower projects, the study showed, suggesting China is eager to finance renewable energy.

Still, the trends evident in the 2023 data do not provide a clear direction for China’s economic strategy towards the continent.Next week’s FOCAC meeting should provide a better understanding of China’s stance towards the continent at a time of heightened geopolitical and geoeconomic tensions between China and the United States and the European Union.

By: José Correa Nunes

Executive Director of Angola Portal

[ad_2]

Source link