[ad_1]

By 2024, CFOs in Australia and New Zealand will take a more active role in IT decision-making.

Research from enterprise software solutions company Rimini Street shows that CFOs are now often the ones guiding foundational technology decisions — a responsibility traditionally held by a company’s chief information officer.

This survey, Executive Imperatives: Evolving IT and Business InvestmentsThe survey of 250 CFOs and CIOs in Australia and New Zealand shows that closer collaboration is improving the relationship between CFOs and CIOs, which can lead to higher returns on IT budgets and business investments.

By 2024, up to 70% of technology decisions will involve the CFO

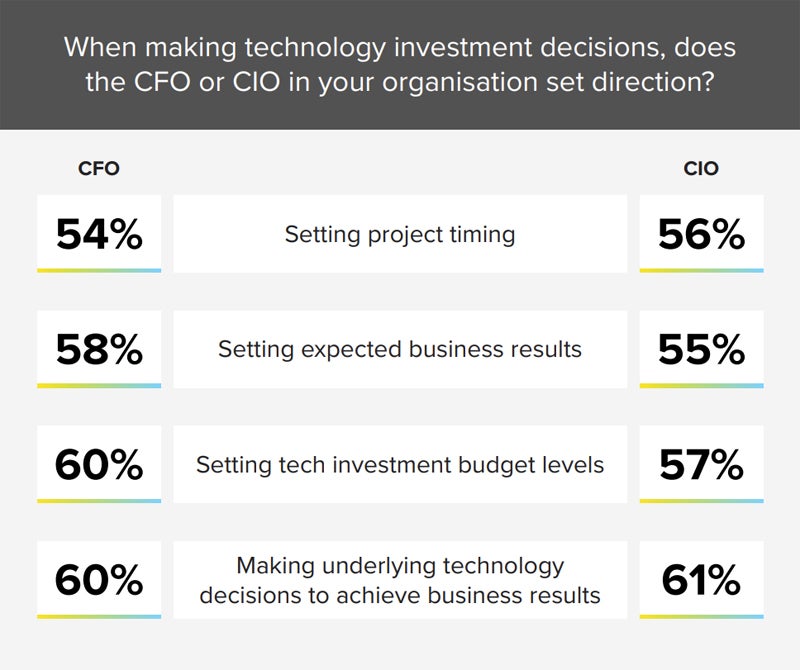

CIOs used to have primary responsibility for technology decisions across the enterprise. However, Rimini Street research found that 60% of CFOs say they are responsible for making the underlying technology decisions that enable business outcomes, signaling a shift in how decisions are made.

ADAPT Research, a professional IT research company, has also noticed this trend. Matt Boon, director of strategic research at ADAPT, said: At a recent Sydney conference, it was estimated CFOs now participate in 70 percent of IT investment decisions, a level that he says is “the highest we’ve ever seen.”

CFOs are not the only ones noticing this shift. CIOs agree that the CFO is the one making foundational technology decisions and taking the lead in setting budget levels for technology investments.

Why are CFOs becoming more involved in technology decisions?

It’s no secret that Australia and New Zealand are increasingly concerned about financial markets. The market has experienced rising inflation, rising interest rates and slowing business growth. IT leaders in the region Pressure to do more with the same or fewer resources Or face the problem of slowing budget growth.

resource: How CFOs can transform from number crunchers to value drivers

This environment has CFOs paying more attention to technology oversight and decision making. CFOs have always been concerned about costs because of factors such as Rising cloud computing costs hit profits. They are also interested in the contribution of technology investments to business growth.

CFOs complain of lack of connection to business goals

Rimini Street reports that only 23% of CFOs are satisfied with the impact of technology investments on their business goals – a primary reason for their increased involvement in technology decisions. This means that approximately three-quarters of CFOs are not fully satisfied with the results of their traditional technology investments or believe that IT investments are not aligned with business goals.

In fact, when asked about technology in their organizations, many CFOs gave harsh feedback. Among the CFOs surveyed:

- 29% of respondents said technology investments have mixed returns when it comes to achieving expected business outcomes or gaining sufficient long-term value.

- 19% said they often see negative consequences of technology investments, including ongoing costs, limited future flexibility, or business disruption.

- In a survey conducted by Censuswide for Rimini Street, 17% of respondents said the majority of their organization’s technology investments are not aligned with their business goals.

- 12% of businesses experience little or no benefit from technology investments and/or the costs of the investment exceed the benefits.

Strengthening the relationship between CFOs and CIOs will benefit the business

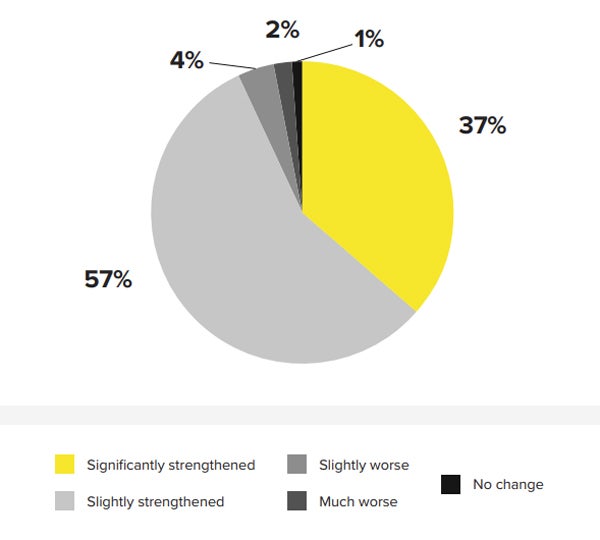

Despite complaints from some CFOs, 94 percent of respondents said the relationship between the CFO and CIO has either significantly or slightly improved, a high percentage considering that the CFO has increasingly encroached on some of the CIO’s traditional responsibilities.

CFOs have a more positive view of CIOs

Closer collaboration leads to a more positive CFO view of the CIO. The survey found:

- 39% of CFOs believe their CIO is an “innovative change agent who drives business strategy.”

- 33% see the CIO as a partner who helps bridge technology and business decisions.

These skills are beyond the core technical strengths of most IT executives, Rimini Street said.

“This says more about leadership and collaboration than technical ability and suggests, at least on the CIO side, that they are learning the language of the CFO,” the report said.

Why the bond between CFOs and CIOs is growing stronger

The uncertain business environment is a factor in the strengthening of the relationship between CFOs and CIOs, as they need to work closely together. According to the Rimini report, some of the reasons given by CIOs and CFOs for strengthening their relationship are as follows:

- Another leader was actively involved (39%).

- Focus on security, compliance and risk (38%).

- There is a pressing need for collaboration to make flexible technology decisions (37%).

- The need to reduce IT costs quickly and in a smart way (35%).

Rimini Street says that due to the complexity of IT decisions, CFOs still rely on their CIOs to guide them on technology priorities, such as security and emerging technologies. CIOs look to their CFOs to assist them with budgeting and executive advocacy.

CFOs believe closer collaboration with CIOs is good for the business

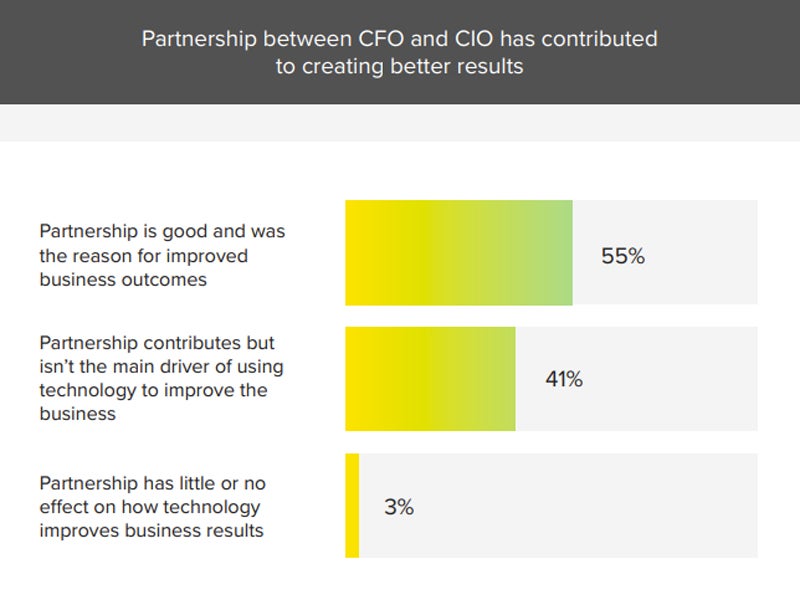

More than half of Australia and New Zealand CFOs (55%) believe a good CFO-CIO relationship is critical to improving business outcomes, with 41% believing that even if this partnership is not the primary driver of improved business outcomes, it still plays a role.

There is still room for improvement in the business relationship between CFOs and CIOs

The relationship between the CFO and CIO could be improved. For example, both CFOs and CIOs believe that the other party should better understand their responsibilities:

- A large portion of CFOs (91%) say their CIO colleagues need to be more business savvy in order to better communicate with them.

- A total of 96% of CIOs surveyed said their CFO colleagues need to be more tech-savvy to improve communication with them.

Why the relationship between CFOs and CIOs has deteriorated

A small minority (6%) of CFOs report having a poor relationship with their CIO. Of these CFOs, 38% attribute the problem to a lack of expertise in addressing security, compliance and risk issues, while another 38% believe the CIO lacks flexibility when looking for ways to cut IT costs.

Other reasons for CFO dissatisfaction include a lack of urgency from the CIO (23%), insufficient return on investment from proposed initiatives (23%), or a lack of willingness to engage in more proactive activities (23%). These issues suggest that both skills and work styles can be flashpoints in relationships.

How IT leaders can better communicate with their CFOs

Savvy IT leaders have the potential to better leverage thriving CFO relationships to advance IT interests within their organizations—particularly when it comes to budget and investment.

Get used to working more closely with your CFO

IT budgets are growing as a percentage of total revenue, with 79% of Rimini Street report respondents indicating that IT budgets are increasing. As IT’s importance continues to rise, both in terms of costs and as a driver of business value, CIOs should expect more involvement and oversight from their CFOs.

look: Four proven ways to increase CIO value in 2024

Rimini Street added that CFOs’ dissatisfaction with technology investments could lead to increased engagement.

“This (CFO dissatisfaction) sends a clear signal to CIOs that they expect increased collaboration with business partners and are prepared to accept increased oversight to ensure their technology choices drive business value,” the report said.

Studying how CFOs evaluate technology decisions

CIOs can benefit from better understanding how CFOs assess the value of new technology investments. As expected, Rimini Street found that CFOs are more focused on the financial impact of investments. The top five factors CFOs consider in technology investments are:

- Strategic value to the enterprise.

- Sustainability of technological solutions.

- Expected return on investment.

- Easy to maintain and support.

- CAPEX and OPEX considerations.

What CFOs want CIOs to focus on

CFOs may have different views on what CIOs should focus on. For example, the study found that CFOs want CIOs to prioritize risk management and compliance, customer success and engagement, major ERP re-implementations and migrations, and revenue-generating technology.

CIOs may have different opinions than their CFOs when discussing technology-related decisions — especially given the importance of risk management and compliance to the CFO. But CIOs can be assured that, overall, the CFO is more focused on outcomes and return on investment than on technology itself, Rimini Street said.

Don’t use “shiny toys” and emerging technologies lightly

CIOs are very interested in emerging technologies: 64% of CIOs surveyed are already investing in AI, with another 28% planning to invest this year. However, they also understand the need for caution, with 34% saying they are simply supplementing existing enterprise technologies rather than investing in new innovations.

look: 3 Best Practices for CIOs to Leverage Emerging Technologies to Achieve Business Outcomes

This cautious attitude may further support the relationship between CFOs and CIOs. Rimini Street found that CFOs are not necessarily opposed to the introduction of emerging technologies, but they express a desire to ensure that they get the most value from new technologies.

CFO is willing to provide future IT budget support to CIO

CIOs will benefit from closer collaboration with CFOs. The report found that if the CIO presents a reasonable IT investment proposal to the CFO and can demonstrate the return on investment, 23% of CFOs are willing to engage with the board to secure the necessary funding.

This bodes well for the future of the CIO. To stay competitive, businesses will need to remain agile and invest in new technologies like AI, and the support and strong relationship foundation of the CFO may be the fulcrum of future success.

[ad_2]

Source link