[ad_1]

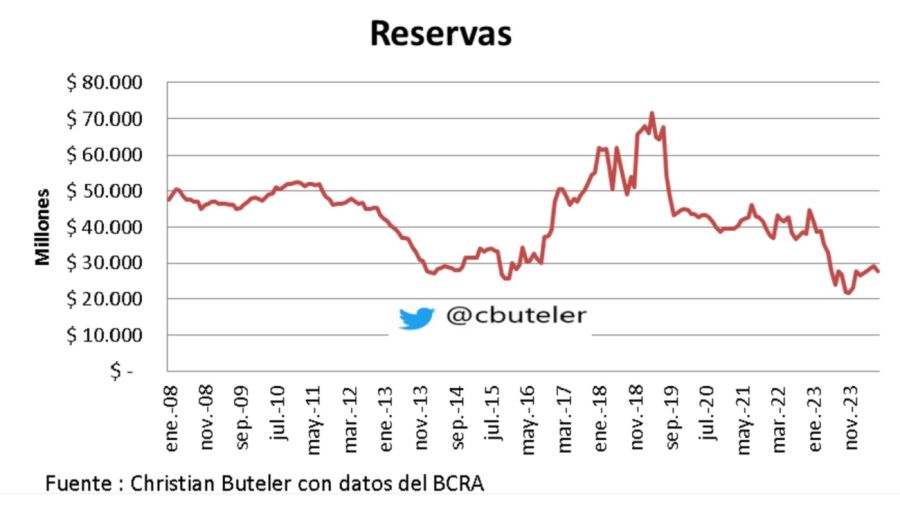

The first week of the new phase of the planzero emission“, he Central Bank of the Argentine Republic (BCRA) Ends at Negative balance in foreign exchange market: $105 million. at the same time, Gross international reserves fell by $708 million And fell back to the level of early April.

As exchange operator Gustavo Quintana explained, BCRA cuts $106 million this Fridaywhich was “the highest daily sales this month and the most significant since June 19 last year.” This dynamic led to a reduction of $42 million in reserves, $27.566 billion.

Dictators don’t like this.

Professional and critical journalism practice is a fundamental pillar of democracy. That is why it troubles those who think they are in possession of the truth.

Bookings down this week

Despite the weak weekly performance, Cumulative amount in July remains positive at $122 million In net purchases. If you look at this movie from a hypothetical Javier Miley By mid-December 2023, foreign exchange accumulation exceeded US$17 billion.

Regarding current behavior, economists Gabriel Camano Expected rebound in MAE trading volumes $342 million When it shows an average of $200 million.

“The high volume of wholesale currencies is not due to a large number of liquidations. This is because BCRA’s sales are strong. Total reserves are down today ($42 million) as a result of yesterday’s. Today’s sales impact Monday. That explains why CCL is so determined. ” explains the head of consulting firm Outlier.

In practice, the official strategy has an impact on the financial sector that controls the dollar. Cash settled this week contracted 5.8% to $1,328The retreat MEP reached 5.9% ($1,331) and Blue fell 3.7% to $1,445This results in a 43% difference in exchange rate compared to the financial offer and a 55% difference in exchange rate compared to the free draft.

“From 04/23 to today The exchange rate appreciated by 40.1%while at that time the BCRA intervention in the MULC resulted in cumulative purchases of about $4 billion, now sales are $143 million, “they pointed out from Aurum Valores.

The IMF and imports: Reasons for the decline in reserves

The last few fiscal days have been dominated by the closure of the issuance channel for the purchase of US dollars. In order to reduce the gap between the official and parallel exchange rates, the Ministry of Economy and the BCRA have developed a strategy that includes: Intervention in CCL and MEP to eliminate the issued pesos At the same time, supply is tightened to curb growth.

Meanwhile, the Treasury paid off its maturing debts. International Monetary Fund (IMF) USD 640 Wanhe Central Bank Selling US dollars to import energy Both factors influence the decline in physical holdings of money during the winter season.

Meanwhile, the entity led by Santiago Baucilli sealed Buyback of 78% of put options Those in the hands of banksThe operation implies a potential reduction of US$ 13.2 billion, and although there is still some surplus in the portfolios of financial entities, it defines a new step towards exiting the exchange rate trap.

Most-Favoured-Nation Treatment

[ad_2]

Source link