[ad_1]

Pgiam/iStock via Getty Images

PJT Partners (New York Stock Exchange:PJT) recently reported earnings. Secondly, the advisory business is growing, and the placement business also grew year-on-year in the second quarter. PJT focuses on relatively large market capitalization transactions in the advisory business and has a particularly clear The restructuring franchise tends to have a greater impact on performance than other investment banks. As we have previously reported, this I’ve been kicking it hard lately.The good thing about PJT is that they will continue to grow for some time from now. Their liability management and restructuring business is doing well right now, and when the economic situation starts to normalize, it will resume other key end markets, namely private equity activity, which is good for their advisory business and Park Hill placement business. This also means that they are more expensive. Although the gap has narrowed, we still prefer Lazard (Latin America).

income

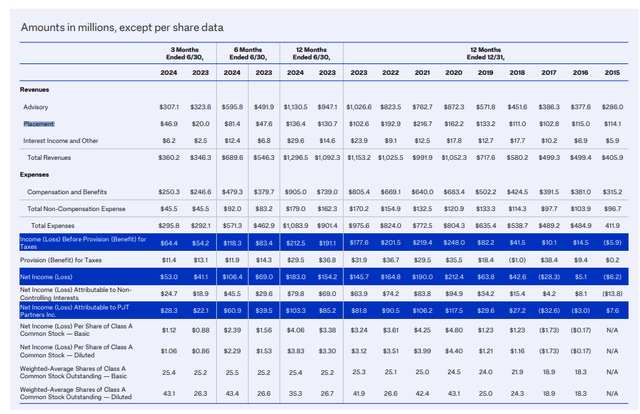

this result Here are the following:

Overall, activity levels are rising so far this year. The growth rate has reached 30% Activity was strong. Both consulting and placement businesses saw significant sequential improvements. Consulting business was down year-over-year in Q2, but still up from Q1, while placement business was up both quarter-over-quarter and year-over-year in Q2. Both consulting and placement businesses have grown significantly over the past 6 months.

The placement business has several tailwinds. While the sponsorship market has been challenging, 15-20% YTD Competition for quality assets is intense among some players, as competition to deploy cash reserves is fierce, and ultimately advisors will have fewer closed deals to profit from, so they need to find secondary investors to invest in funds and companies and raise new capital without cash reserves or exit funds. Some limited partners need liquidity, but redemptions are not possible in the current environment because Lack of portfolio rotation. 2021 Vintage It’s the bloat in the allocator’s portfolio, and if you exit in the current environment, you have to write all of that down. There’s no rotation in the portfolio, so there’s almost no redemption activity.

This also means that the business is dealing with some headwinds. Due to the lack of exit opportunities, LPs cannot get redemptions and they cannot redeploy capital, which means that compounding has stopped, reducing the frequency and overall size of capital raises. In addition, funds already have a lot of money, so new raises must wait until the capital is deployed. Against this backdrop, the business is showing solid growth, which is good. On the other hand, LPs are also pressuring funds to return capital, which will also provide funds for sponsor-facing business, including placement business for fundraising.

The placement will accelerate further when sponsor activity resumes, but it is unclear when that will happen. Timing is a factor in private equity marketsIn these markets, PEs are too competitive, too experienced, and too efficient to get great deals, so they may wait until there are a few rate cuts before taking action, as they will have to rely on leverage to maintain returns. Rate cuts should restore portfolio rotation and PE activity in financings, which should continue the growth momentum of placements after the down cycle.

As for advisory, mid-cap stocks are doing well, but this is not PJT’s area as they are more focused on large-cap and block stocks. Restructuring activity is fairly solid and some bankruptcies are starting to emerge, but most activity is still in liability management. The company believes they should get some traction from AI disruption and are eager to stay ahead and not be seen as lagging by shareholders. If interest rates remain high, large and complex bankruptcies should steadily increase. They have already This year has begun to recover from the historical lows of the past few years It increased by 16% year-on-year. It is still at a historical low, so it is conceivable that there is still room for such growth. The huge debt scale also supports liability management for a period of time. Mature wall Very big, Not that scary thoughreflecting the strength of the liability management business, where a lot of activity and demand for corporate credit has pushed spreads to historical lows despite unresolved and concerning macroeconomic issues. In the current environment, liability management solutions have a higher value-add as much of the outstanding debt is less covenanted due to lending practices over the past few years. Large caps do take a back seat to the consulting space, and normalization of interest rates should also bring back large cap and large cap activity. It should be noted, however, that PJT is quite counter-cyclical in the consulting space. If interest rates normalize, especially if they fall sharply, their growth will be lower than their peers.

As the last iteration of COVID-19 era data shows, non-compensation expenses have risen over the past 6 months. Compensation expenses have remained stable over the past 6 months, and revenue growth in the second quarter was fairly close. The compensation ratio should remain fairly stable.

in conclusion

PJT is counter-cyclical. There are many speculations Rate cuts coming soonUnless we see a material decline in inflation or a decline in survey inflation expectations, we will not be convinced. A material change in employment would be the only other factor that would convince us of a rate cut. The Fed could signal a rate cut for a variety of reasons, including to influence expectations. There is a lot of dissent within the FOMC, and the arguments against rate cuts, and even more recently for further rate hikes, seem to be well-founded. Without data, we will not be convinced of a rate cut.

However, if rates are cut, while PJT will continue to grow operationally, it will not grow as fast as many of its peers. Any investment bank boutique business will grow faster and will be more affected by factors such as the recovery in PE activity.

In a mid-cycle environment, we can understand the PJT premium as it is more resilient than its peers, but as key end markets have been depressed for some time, we tend to believe we are closer to an upward inflection point in activity. PJT trades at around 30x forward earnings for this year. Our top picksDespite the Lazard share price rally, its share price is still lower. Both PJT and Lazard have been slightly muted in the upcycle, Lazard because its asset management business is much less volatile. If we were convinced that a rate cut was likely, we might start looking at Moelis (Congressman) has a very important sponsor franchise and is likely to benefit the most from the recovery in PE activity, although its PE is much higher than other companies at 58x. The operating leverage of these businesses is quite high, so if you are sure that revenue growth is coming, a forward PE of 58x is not uninteresting. But we think things will drag on for a while and expect MC to have another entry opportunity in the coming months.

[ad_2]

Source link