[ad_1]

JHVE Photos

Given its solid results and soaring stock price, Nvidia (Nasdaq:NVDA) set a very high bar. This quarter, the bar may be even higher as the company seems to be having more and more trouble surprising investors.

Nvidia expects Analysts expect the company to report another strong quarter on August 28, when it reports second-quarter results for fiscal 2025. Earnings and revenues are expected to more than double from the same period last year to $0.65 per share on revenue of $28.7 billion.

Guidance is critical because expectations are high and the market has become accustomed to big growth and even stronger guidance. For the third quarter of fiscal 2025, analysts expect earnings to grow 77% to $0.71 per share and revenue to grow 75.4% to $31.8 billion.

Adjusted gross margin is also an important indicator. Currently, analysts expect adjusted gross margin in the second quarter to be Gross margins for the third fiscal quarter were 75.5% and 75%, respectively.

Fewer upside surprises

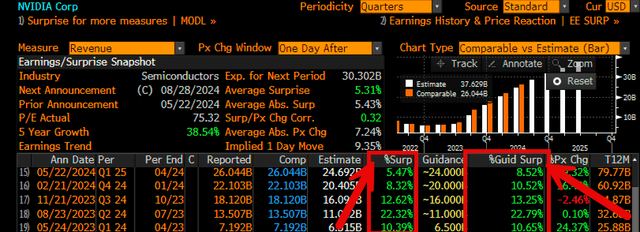

One thing that’s worth noting over the past few quarters is the steady decline in the beat rate. This means that Nvidia is reporting revenues closer and closer to analysts’ expectations, which means the upside surprises are shrinking.

In addition, the surprises in earnings guidance have also gradually weakened over the past four quarters. For example, in the third quarter of fiscal 2024, earnings guidance was 22% higher than analysts expected, while the previous quarter’s earnings guidance was only 8.5% higher than analysts expected. This shows that analysts are beginning to catch up with the company’s expected guidance, which sets a higher bar for each quarter and is more difficult to exceed.

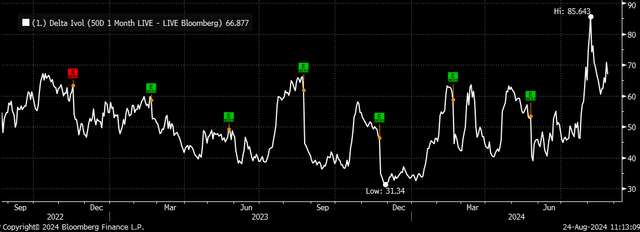

Higher implied volatility

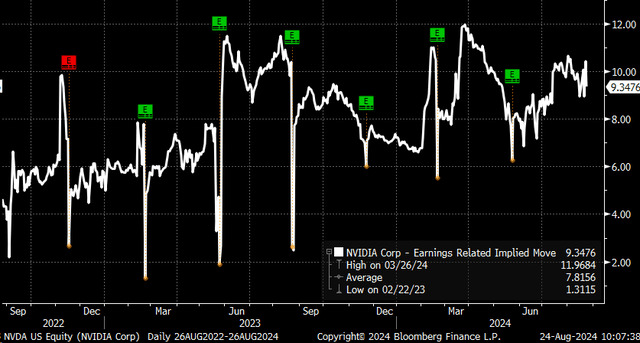

The market seems a little uncertain about the company’s performance this quarter and expects the stock price to rise by about 9% after the earnings. Based on the closing price of $129.37 on August 23, 2024, the stock could trade in a range of $117 to $141.

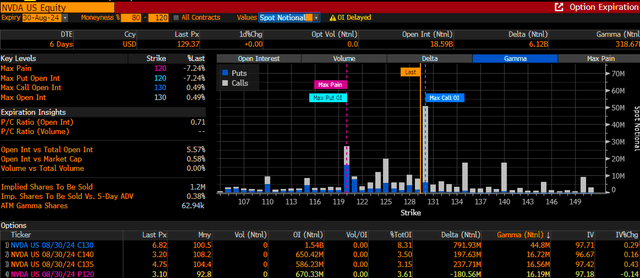

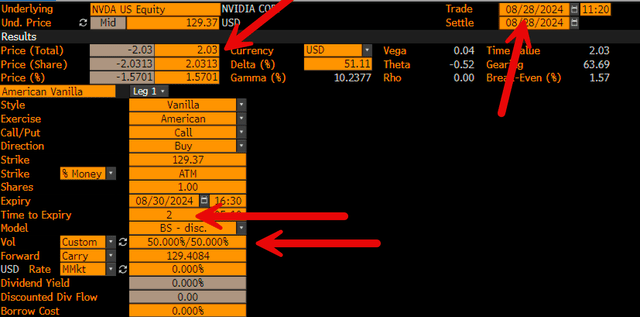

This is because the implied volatility levels for options expiring on August 30 are very high. Currently, the implied volatility for the $130 call option is around 100%, and it is likely to continue to rise as we approach the earnings date on August 28. This is one of the reasons why Nvidia stock has not been able to break through the $130 level in the past few trading sessions. The $130 gamma level is very large, and these important option gamma levels often act as support and resistance levels.

Options Dynamics

Many call options have delta built into the $130 price level, which is also helping to act as resistance in the market right now. As we head into Nvidia’s earnings period, these deltas and gammas are likely to get bigger due to rising implied volatility levels. This means that option hedging flows will support the stock price and help it keep earnings around $130.

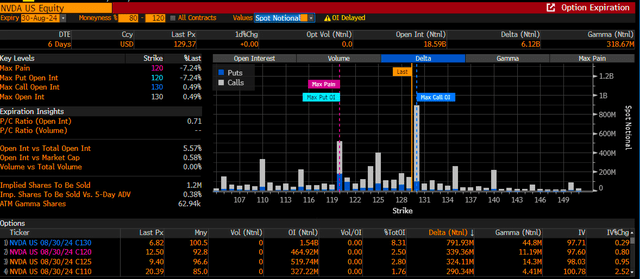

However, the biggest risk is what happens to implied volatility after the results are released. Because once the results are released and the event risk has passed, implied volatility will drop significantly. Historically, implied volatility has almost halved. Because of the way option pricing works, once implied volatility levels fall, premiums for both puts and calls will drop significantly, which will reduce the amount of delta and gamma in the market that acts as support and resistance. This means that market maker hedging flows may need to decrease because a lot of positions are currently in call options.

In fact, the current premium for the August 30 call option expiration is $130, or $6.82 per contract. This means that by August 30, the stock price needs to rise above $136.82 for new buyers to profit, or about 6% above last Friday’s price. However, if implied volatility falls to 50%, the contract will be worth only $3.61, and after adjusting for time value, it will be worth only $2.00 per contract.

This means that if the stock price does not rise above $137 after the earnings report, at least based on current market conditions, then the $130 call option will depreciate significantly after the earnings report, regardless of how good or bad the actual report is. This could lead to significant hedge inflows. Last quarter Very similarly, what saved the share price back then was a 10-to-1 stock split, which helped provide the momentum needed to push the share price higher.

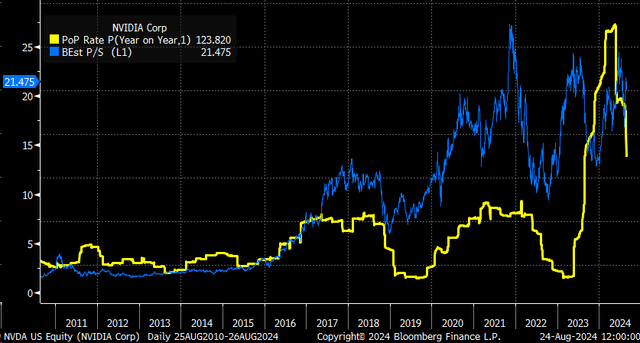

Peak growth

Additionally, it’s clear that Nvidia has passed its revenue growth peak for this cycle, and historically the stock’s price-to-sales multiple has tended to expand and contract with revenue growth rates. This isn’t to say that Nvidia’s stock will return to trading at 5 or 6 times forward sales, but it does suggest that the current 21 times trailing 12-month price-to-sales multiple will likely be achieved in the coming quarters.

Maybe the P/E will return to closer to 10 times sales, but if revenue grows to around $225 billion as analysts predict, the stock could maintain a market cap closer to $2 trillion. But much depends on how fast sales grow in the future.

But the company’s long-term fundamentals may not matter at this point. What seems more important, at least for now, is the momentum behind the stock and, more importantly, the options positioning of the stock. Based on current positioning, Nvidia would need to reverse its current trend and deliver a bigger upside surprise on both actual revenue and expectations to push the stock to resistance around $130 to $135.

[ad_2]

Source link