[ad_1]

Philo

Realty Income Corporation (New York Stock Exchange:oh) Second-quarter FFO beat expectations on strong leasing activity, and the commercial REIT once again easily covered its dividend with adjusted funds from operations.

Real estate income has a As the industry increases spending on artificial intelligence, the growth in operating funds in the data center market presents considerable opportunities.

The REIT also reaffirmed its forecast for adjusted funds from operations through 2024, and passive income investors can reasonably expect the dividend to continue growing in the future.

I think Realty Income’s shares are still quite attractively valued at the $60 level, and the risk/reward profile is favorable for passive income investors.

My Rating History

Active trading activities, active gaming industry transactions, good dividend safety margin Support My Stock Classification Strong Buy.

I believe that from a dividend safety perspective, Realty Income remains a “strong buy” stock given strong second quarter 2024 results, and I would venture a guess that the data center industry as a new business area in the future may become more attractive to Realty Income.

Q2 2024 Results and Data Center Growth Opportunities

Realty Income reported second quarter funds from operations of $1.06 per share and beat earnings estimates by $0.01 per share on strong leasing performance. The trust maintained a high portfolio occupancy rate of 98.8% in the second quarter and benefited from strong year-over-year growth in adjusted funds from operations.

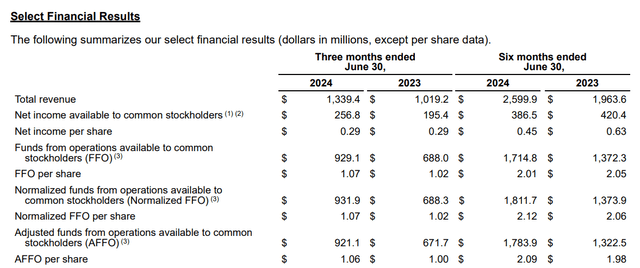

Working Capital (Realty Income Corporation)

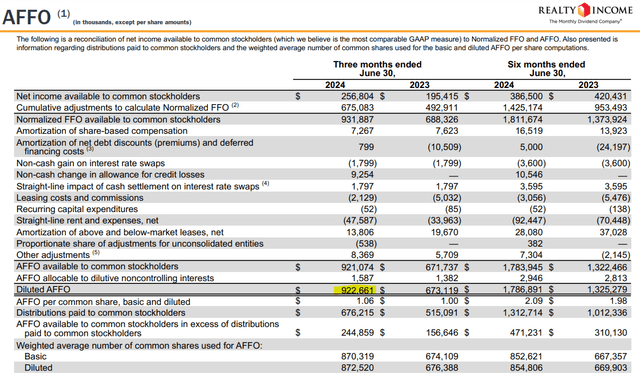

Realty Income’s leasing portfolio generated $922.7 million in adjusted funds from operations in the second quarter of 2024, up 37% year over year, driven primarily by acquisitions. On a per-share basis, the growth was much more modest, with Realty Income’s metric up 6% year over year.

Australian Federal Aviation Administration (Realty Income Corporation)

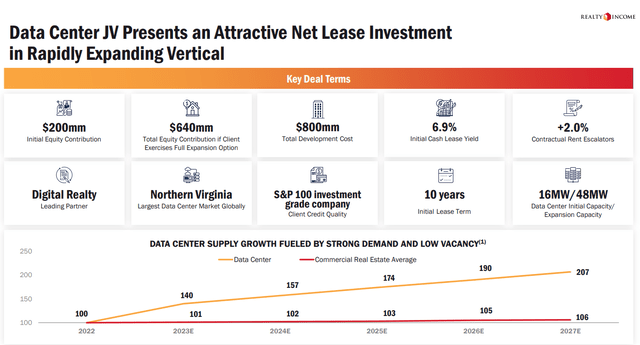

Last year, real estate income and Digital Realty Trust, Inc.German Space Agency)Established a joint venture to invest in the data center industry. Realty Income invested $200 million and acquired 80% of the equity. The joint venture will expand its influence in the custom data center market in the future.

As AI is clearly driving huge demand for data centers, the outlook for investment and capital allocation in the industry is very favorable.

Most importantly, I believe the data center market presents a new opportunity for Realty Income to diversify its rent sources and create new leverage for adjusted funding from operating growth.

Digital Realty Trust is a fast-growing data center real estate investment trust that has benefited from strong, secular demand for computing power and, like Realty Income, Ultra-safe dividends for passive income investorspaid for by working capital. Data centers stand out with their long lease terms, low vacancy rates and strong sublease activity, making them clearly attractive from an investment perspective.

Key Transaction Terms (Realty Income Corporation)

Dividend Coverage

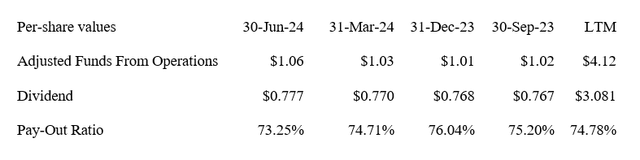

Realty Income’s adjusted funds from working capital in the second quarter was $1.06, enough to cover its dividend of $0.7765 per share.

The dividend payout ratio was 73% in the second quarter, the lowest in the past year. In the past twelve months, Realty Income paid out 75% of adjusted funds from operations, reflecting a high margin of safety for passive income investors.

dividend (Author created table using trust information)

Realty Income announces its 126day The dividend was increased in June and is now $0.2630 per month, a 1.6% dividend increase.

Realty Income’s low AFFO payout ratio and consistent past dividend increases make the trust’s stock particularly compelling for its dividend growth prospects.

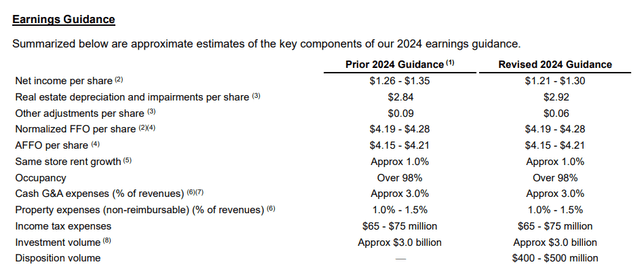

AFFO Guidance and Multiples

Realty Income reaffirmed its 2024 guidance and continues to expect adjusted funds from working capital of $4.15-4.21 per share. Given that the stock is currently selling for $60.28, the REIT is valued at 14.4 times its projected 2024 AFFO.

Kimco Real Estategold)a shopping center REIT, is selling for 13.4 times estimated 2024 funds from operations. Digital Realty Trust, the data center-focused REIT mentioned above, is selling for 22.0 times funds from operations.

I believe Realty Income is an attractive investment for passive income investors at this multiple given the high margin of safety and growth opportunities in commercial real estate, especially data centers.

Profit guidance (Realty Income Corporation)

Why the investment thesis may be wrong

Realty Income has consistently delivered strong dividend payout metrics and coverage results. From what I understand, commercial REITs also have strong growth opportunities in the data center market, which is expected to see more capital deployment and growth in the future.

Realty Income also delivered solid AFFO growth in the second quarter, and only if that growth fades away will I see reason to change the stock’s classification.

My Conclusion

I believe that real estate income is one of the best investments a passive income investor can make for the long term.

Realty Income has continued to increase its dividend, and the REIT also has a high margin of safety based on adjusted funds from operations. The portfolio remains well utilized in the second quarter, with occupancy rates approaching 99%, and more acquisitions are likely in the future.

Looking ahead, I expect the company to increase its investments in the data center industry, which will allow Realty Income to solidify its joint venture partnership with Digital Realty Trust. The company’s stock valuation is also quite attractive in my opinion.

I also think Realty Income could be an especially good investment during times of heightened market volatility, which investors experienced last Monday, because the trust has a long track record of dividend increases and should have no problem paying dividends out of AFFO in the future.

[ad_2]

Source link